These are the best cities to buy in for real estate investors

Real estate investors that are looking to increase profits this year may want to head inward. According to new data, the Midwest region is home to the nation’s three best cities for residential investments. The best spots for Real Estate Investors According to the Q1 Residential Real Estate Investment Rankings from Compound, the Midwest is robust with investment […]

Why Is The Gap Between Owner and Appraiser Home Value Opinions Widening?

Homeowners Overestimate Home Value Growth The average American homeowner thinks their home is appreciating faster than appraisers do. Appraisal values in January were an average of 0.47 percent lower than what homeowners estimated, according the national Quicken Loans Home Price Perception Index (HPPI). January was the third consecutive month in which the gap between these […]

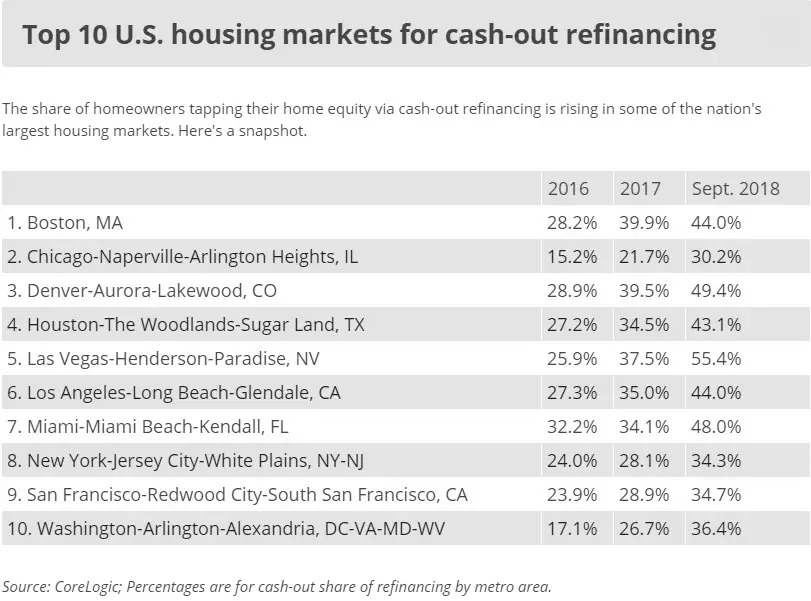

Cash-out mortgage refinancing: Here’s where homeowners are using it most

The Growth of Cash-out mortgage Refinancing in Recent Years Homeowners who snagged a low-interest rate mortgage in recent years have a big incentive to avoid refinancing the loan because interest rates are higher now. When they need a large amount of cash, though, some homeowners are turning to Cash-out mortgage refinancing — even if it […]

Are baby boomers to blame for the lack of housing inventory?

For once, it’s not the millennials’ fault. Existing-home sales are on pace to fall 2.3% year-over-year in 2018, and the baby boomers generation is a big reason why, according to Fannie Mae Chief Economist Doug Duncan. Housing supply has been an ongoing challenge in the residential real estate market and unfortunately, the industry can’t just […]

When Is a Cash-Out Refinance Loan a Good Idea?

When using a cash-out refinance to pay off debt, make sure you are not at risk of running up that debt again. In a cash-out refinance mortgage, you take a Refinance Loan against your home in excess of what you owe, leaving you with cash available to spend. Adding to the debt against your home […]

Why Should Homeowners Refinance Now?

Refinancing a mortgage makes a lot of sense—if the math is in the borrower’s favor. If they can reset their loan at a lower interest rate than what they’re currently paying, they may be able to: Homeowners Refinance now and save big Take cash out at closing to cover a home improvement project, pay off […]

Online Leads Generation Activity Accounts for Nearly 23% of Total Refinance Originations in the U.S. for Q1 2018

iLeads.com® Analysis Reveals $29 Billion in Loan Originations from Online Leads Generation Newport Beach, CA, August 22, 2018 –(PR.com) — In its latest analysis of over 2 million Internet generated mortgage leads, iLeads.com® concluded that online consumers drove over $29 billion in loan origination dollars and accounted for nearly 23% of total refinance originations in […]

Is Housing Sentiment Still Optimistic?

While Americans still feel it is a good time so sell a home and an okay time to purchase one, in June at least, they were feeling a little edgy about their job security. Fannie Mae says its Home Purchase Sentiment Index, a measure based on results from the National Housing Survey (NHS), declined last […]

A virtual treasure trove of lead analysis from 2017

We analyzed and broke down data on 7.2 million leads. Here are the results:

We’re Heading to LeadsCon! Here’s Why.

LeadsCon Is The World’s Leading Conference and Expo on Acquisition and Conversion Strategies! MARCH 5-7, 2018 THE PARIS, LAS VEGAS LeadsCon is the premier channel for companies providing lead generation products and services to network with key buyers, decision makers and industry professionals all looking for ways to expand their customer acquisition business. By exhibiting […]