Mortgage Lead Intelligence

Know which borrowers can actually fund.

What is Revive? Revive analyzes real property and mortgage data to determine who can actually fund, before you ever call.

Every lead is pre-qualified by reality

Revive filters out dead ends and surfaces homeowners with real funding capacity.

Instant clarity on who to call first

See fundable now, nurture later, or never call again.

Built for funded outcomes

Replace trigger-heavy volume with a compliant pipeline designed to close.

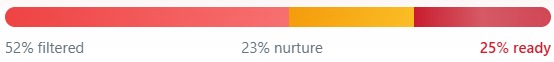

Total Leads

10,000

- Non-Fundable

5,200

- Watch List

2,300

- Fundable Now

2,500

Beyond Mortgage

Revive intelligence applies anywhere timing and financial readiness matter.

Revive for Insurance

Revive for Solar

Why lenders use iLeads and Revive

Lead intelligence, not just more leads

Better cost per funded loan

Works on both bought leads and your own data

One Revive engine. Two primary ways to use it.

Revive is the underwriting brain behind every iLeads program. It connects leads and homeowner records to live property and mortgage data, then classifies each record into fundable now, not fundable under current conditions, or watch list for future campaigns.

Revive Leads

Lead files sourced from the iLeads universe and filtered by Revive before you ever see them. Each record is matched to property and mortgage data, evaluated against your product and underwriting criteria, and delivered only if it is fundable under your rules.

- Work fewer, better records across your sales team.

- Target specific products like cash-out, streamline, HELOC, purchase, and retention.

- Feed dialers, CRM, and marketing programs with pre-qualified targets.

ReviveIQ For Your Data

- Get a clear view of what is actually in your CRM and aged lead stock.

- Focus sales and marketing on fundable borrowers instead of guesswork.

- Build a roadmap of future opportunities with watch-list segments.

Revive Conquest

Use Revive to design competitive and portfolio plays based on product type, equity position, and loan patterns. Target specific competitors, protect your own book, and build high-intent audiences for mail, phone, and digital.

How Revive turns records into fundable opportunities

Same leads and CRM. Different outcome.

1

Input: Leads and CRM records

2

Enrichment with live property and mortgage data

3

Fundability logic

4

Classification and delivery

The result is a pipeline based on who can actually fund, not just who filled out a form.

Results that matter to revenue

Lead intelligence is only useful if it shows up in funded loans and lower CAC.

More funded loans from what you already own

Better cost per funded loan

Compliance-ready, post-trigger pipeline

Where lenders use Revive today

Upgrade internet lead programs

Monetize CRM and aged leads

Conquest and portfolio plays

Lead management and routing

Your Post-Trigger Pipeline starts with the data you already own.

Trigger programs are constrained and under scrutiny. Borrowers will keep shopping, but the way you find them has to change. Revive shows you how much of your next 12 months of funded loans is already sitting in the leads you buy and the data in your CRM.

- Understand your mix of triggers, real-time leads, and CRM.

- See which borrowers can actually fund now.

- Build a Post-Trigger Pipeline that is compliant and tied to real fundability.

Built on years of watching what actually funds.

iLeads has spent years watching how internet leads and homeowner records behave through multiple market cycles. Revive packs that learning into a live lead intelligence engine that runs on current data. The story is not how long we have been around. It is how precisely we can now show you who can fund.

See Revive in action

Post-Trigger Pipeline overview

ReviveIQ snapshot example

Revive Leads program summary

Want a view based on your own data?

Other iLeads products that work with Revive

Revive is the lead intelligence engine. These products are how data flows in and insights flow out across your tech stack.