Home Prices Moved Up Even Faster in January Despite Higher Rates

There’s a friendly debate among economists and housing experts on the implications of 2022’s massive spike in mortgage rates. We hope you enjoyed last week’s edition where we talked about Profit Margins Are Plunging For Nonbanks. This week we’re bringing you: Here We Go Again: Mortgage Rates Making Another Recovery Attempt In a normal mortgage rate […]

Profit Margins Are Plunging For Nonbanks

Nonbanks and mortgage subsidiaries of chartered banks reported grim profitability figures in the fourth quarter of 2021, when costs reached a new high and margins fell to the lowest level since early 2019. We hope you enjoyed last week’s edition where we talked about Rents Are Rising 4 Times Faster Than They Did In 2020. This […]

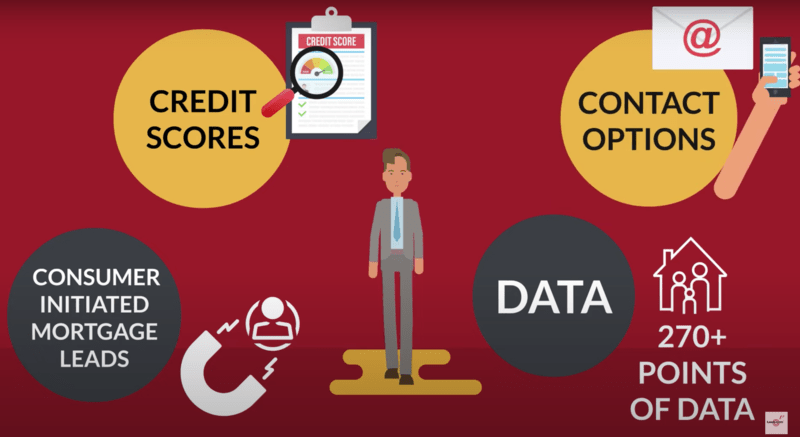

What Opportunities Do Lenders Miss Out On By Not Focusing On Credit?

With industry loan volumes already falling, lenders are looking for ways to reach their growth goals. We hope you enjoyed last week’s edition where we talked about Are Digital Closings Really Worth It? This week we’re bringing you: Welcome to Walmart. Here’s your mortgage Cooperative leasing spaces in Walmart to sell mortgage products to consumers […]

Mortgage Applications Continue Downward Trend | Top Predictions

Mortgage applications decreased 13.1% for the week ending Feb. 18 to the lowest level since December 2019, as mortgage rates eclipsed the 4% mark. We hope you enjoyed last week’s edition where we talked about Conforming Loan Access At Nine Year Low. This week we’re bringing you: What should lenders look for in servicing solutions?* […]

Conforming Loan Access At Nine Year Low | Mortgage Credit Deep Insights

Even as the economy is improving, access to mortgage credit fell in January as investors cut back their demand for some products. We hope you enjoyed last week’s edition where we talked about Ron Terwilliger On How To Make More Affordable Housing? This week we’re bringing you: Lender/Broker Products; Events and Training; Cap Markets […]

Origination Report Shows Dramatic Changes Over 2021

The Origination report for December 2021, however, allows us to see that, in some respects, the mortgage market has evolved significantly over the last 12 months. We hope you enjoyed last week’s edition where we talked about How Will Appraisal Technology Evolve In 2022? This week we’re bringing you: FHA, VA News Impacting Lenders; Vendor Tools* […]

Automation Helps Lenders Respond To Rising Mortgage Rates

Higher inflation, post-pandemic economic recovery, and a reduction in Federal Reserve stimulus incentives are key economic factors expected to put upward pressure on interest rates as we move into 2022 — increasing the already stiff competition among mortgage lenders. This is why, mortgage rates increased in 2022, We hope you enjoyed last week’s edition where […]

Loan Officer Commissions Flatten As Refis Dry Up | Pro Tips To Overcome This

To the surprise of virtually no one, loan officer commissions started to head south in the third quarter, dropping 17% year-over-year, according to SimpleNexus’ third-quarter mortgage loan compensation report. We hope you enjoyed last week’s edition where we talked about How Much Could Wire And Title Fraud Cost Lenders? This week we’re bringing you: Zillow to […]

How Lenders Can Turbocharge Mortgage Operations for Today’s Home Buyers

Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about Are Consistently Error-Free Closings Within Reach For Lenders? This week we’re bringing you: How Lenders Can Turbocharge Mortgage Operations for Today’s Home Buyers Study: […]

Are Consistently Error Free Closings Within Reach For Lenders?

Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about Construction Numbers Pushed Higher by Multifamily Surge. This week we’re bringing you: Loan origination complaints spike during pandemic* White borrowers are more likely to […]