Is it a race against the clock? A mortgage cash-out refinancing spree is here

Some 2.43 million homeowners can reduce their mortgage interest rate by refinancing, according to a recent mortgage report by Black Knight, a mortgage data and analytics company. One such way to do this is through cash-out refinancing , an increasingly popular way for homeowners to draw equity from their homes while lowering their interest rate. Refi applications […]

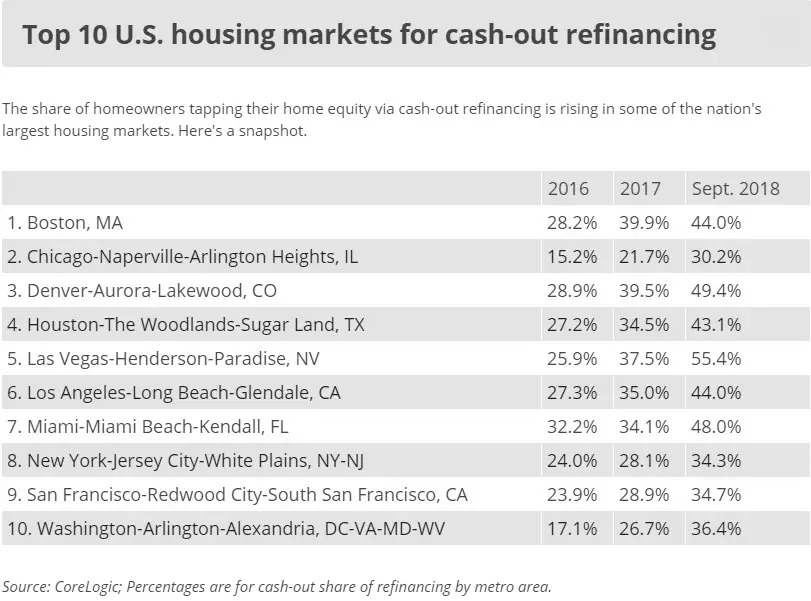

Cash-out mortgage refinancing: Here’s where homeowners are using it most

The Growth of Cash-out mortgage Refinancing in Recent Years Homeowners who snagged a low-interest rate mortgage in recent years have a big incentive to avoid refinancing the loan because interest rates are higher now. When they need a large amount of cash, though, some homeowners are turning to Cash-out mortgage refinancing — even if it […]

Should You Refinance to an Adjustable Rate Mortgage?

(via Home Loan Advisor) An adjustable rate mortgage (ARM) is a type of mortgage where the interest rate charged on the outstanding balance varies based on a specified schedule. The interest rate is initially fixed for a given period after which the rate is set periodically. There are many advantages associated with the adjustable rate […]

Benefits of Refinancing | 5+ Top Benefits

Are you planning to refinance your mortgage? If so, it’s a great decision because there are a wide range of benefits you will get from doing so. There are times when it is advisable to do the refinancing, but you need to understand clearly all the financial objectives and keep them in mind. Here are […]

Should You Refinance Your Mortgage?

If you are like many homeowners, you may have wondered if you should refinance your existing home mortgage. While refinancing can be one of the best decisions that some homeowners can make, for some, it may not be the best time. And there are many reasons why some should wait. Many people jump into refinancing […]

Making the Most of Cash-Out Refinancing

What Is Cash-Out Refinancing? Cash-out refinancing accesses your home equity through a new mortgage with a bigger principal amount than the current one. You can avail for the difference amount between the principals of the two mortgages IN CASH for almost any purposes. How Cash-Out Refinancing Works Use cash-out refinancing option to obtain a new […]

Easy Refinancing Steps You should follow them

Refinancing can seem like a daunting process, especially if you’re not sure you sure do it in the first place! Under the right conditions, refinancing your home mortgage can be a great financial move depending on your goals. Not only can you get a lower interest rate, you can switch from a 30-year mortgage to […]

Refinancing Obstacles and How to Overcome Them

Refinancing Obstacles your homes After seeing the rates hit the bottom, the job market and economy are slowly improving, and the government is devising new programs to assist homeowners. Now appears to be a good time to refinance your home. In theory, these factors would normally result in creating a home refinancing boom. But in […]

Understanding Home Refinancing

If you’re considering getting your home Refinancing, you need to know what exactly is involved in the process. This is an important decision and if you go about it in the right way, you’ll be able to save a lot of money. But if you take one wrong step, it might prove to be a […]

Top Home Refinancing Tips | Top Tips

If you’ve been waiting for an ideal time to get a home refinance, now is the time to get into action mode. In spite of being slightly underwater on your loan, if you have a good credit rating, some perseverance coupled with reasonable shopping skills can help you bag the best deals this year. Tips […]