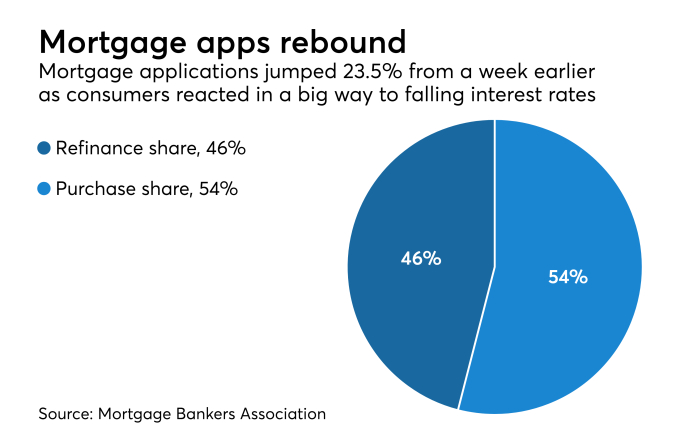

Consumers reacted in a big way to falling interest rates as mortgage applications increased 23.5% from one week earlier, according to the Mortgage Bankers Association. This week’s results include an adjustment for the New Year’s Day holiday.

Interest Rates Drop and Trigger a Surge in Mortgage Applications

During December, even as interest rates dropped, mortgage applications activity also declined.

The MBA’s Weekly Mortgage Applications Survey for the week ending Jan. 4 found that the refinance index increased 35% from the previous week.

Refinance Activity Rebounds: Highest Levels Since February 2018

The refinance share of mortgage activity increased to its highest level since February 2018, 45.8% of total applications, from 42.7% the previous week.

The seasonally adjusted purchase index increased 17% from one week earlier, while the unadjusted purchase index increased 59% compared with the previous week and was 4% higher than the same week one year ago.

Mortgage Rates Fall Across the Board: A Key Factor in the Rebound

“Mortgage rates fell across the board last week and applications rebounded sharply, after what was a slower-than-usual holiday period. The 30-year fixed-rate mortgage declined 10 basis points to 4.74%, the lowest since April 2018, and other loan types saw rate decreases of between 9 and 20 basis points,” Joel Kan, the MBA’s associate vice president of economic and industry forecasting, said in a press release.

“This drop in rates spurred a flurry of refinance activity — particularly for borrowers with larger loans — and pushed the average loan size on refinance applications to the highest in the survey (at $339,800). The surge in refinance activity also brought the refinance index to its highest level since last July.”

Adjustable-rate loan activity increased to 8.4% from 7.6% of total applications, while the share of Federal Housing Administration-guaranteed loans increased to 10.3% from 10% the week prior.

The share of applications for Veterans Affairs-guaranteed loans increased to 11.6% from 11% and the U.S. Department of Agriculture/Rural Development share remained unchanged at 0.6% from the week prior.

Get more details here.