Building the next generation of tech: Three ways to mortgage digitalization. Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about How Lenders Can Turbocharge Mortgage Operations for Today’s Home Buyers. This week we’re bringing you:

Lenders are courting self-employed borrowers again*

Overall mortgage credit availability increased 1.5% in September, but it is far from pre-pandemic levels

Mortgage credit availability increased for the third consecutive month in September, but is still 30% below the pre-pandemic level, according to a report released Tuesday by the Mortgage Bankers Association (MBA). Much of the growth in credit availability has come from loans that cater to self-employed borrowers, who were left in the cold by most lenders during the pandemic.

The MBA Mortgage Credit Availability Index overall rose by 1.5% to 125.6 in September, the highest level since May. The index benchmarks to 100 in March 2012; a higher number portends more mortgage credit availability.

According to Joel Kan, MBA’s associate vice president of economic and industry forecasting, despite elevated rates of home-price appreciation, lenders are offering a wider range of loans to accommodate qualified buyers.

“But, even with increases in seven out of nine months thus far in 2021, total credit availability is still around 30% less than it was in February 2020,” he added.

The Conventional MCAI increased 4.5%, while the Government MCAI declined 0.7%. Of the component indices of the conventional index, the jumbo MCAI increased by 5.8%, the highest level since March 2020, and the conforming MCAI rose by 2.6%.

Affordability Actually Improved in August Despite Surging Prices*

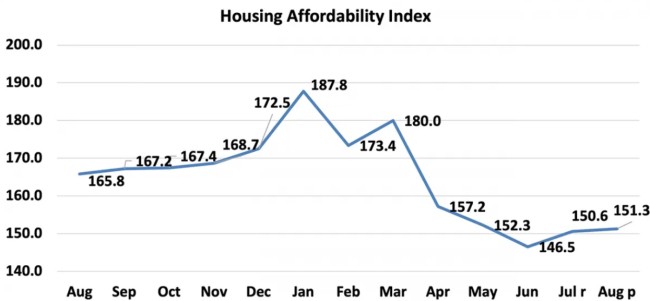

A new report from the National Association of Realtors (NAR) says housing affordability in the U.S. improved in August for the second straight month. NAR’s Housing Affordability Index rose from 150.6 in July to 151.3 but was down from 165.8 the prior August.

The month-over-month increase was the result of a 1.1 percent dip in the monthly mortgage payment and a more modest decline of 0.7 percent in the median income. However, on an annual basis the monthly mortgage payment was up 13.9 percent while family income increased by 3.9 percent. The effective 30-year fixed mortgage rate was down 11 basis points from August 2020 to 2.89% and the median existing-home sales price rose 15.6 percent from one year ago.

The HAI is constructed using median household income compared to the level of income needed to qualify for a 30-year fixed rate mortgage on a median priced home without exceeding 25 percent of that income. A value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home assuming a 20 percent down payment. An index of 120 signifies that a family earning the median income has 20 percent more than the level of income needed pay the mortgage on a median-priced home.

The index exceeded 100 in all four major regions, meaning that a family with the median income had more than the income required to afford a median-priced home. The most affordable region was the Midwest, with an index value of 196.8 (median family income of $86,614 with the qualifying income of $44,016). The least affordable region remained the West, where the index was 114.9 (median family income of $94,372 and the qualifying income of $82,128).

Building the next generation of tech: Three ways to digitize home lending*

Digital transformation focuses on improving an organization’s success

Purchasing a home is one of the biggest investments most people will make in their entire lives, but the complexity of securing a mortgage can be a grueling and fractured process for first-time homeowners. At each stage of the buying process, there are multiple siloed transactions, from appraisals, inspections and settlements to mortgage payments and homeowners’ insurance. The home lending industry has a massive opportunity to digitalize to create efficiencies and to deliver a simpler end-to-end user experience hat would benefit both borrowers and servicers.

Digital transformation may sound complex and disruptive, but transformation can begin with small, meaningful steps. It is important to accept that digitalization is inevitable – customers are already hooked and there is no going back. The good news is that, rather than trying to reinvent the wheel, the home lending industry can get started by translating proven technology patterns, solutions and learnings from other industries that have successfully transformed customer experience and achieved tremendous efficiencies. There are some standout misconceptions about digital transformation, which is why it is important to focus on the ones that are most important.

Digitalization Can Start Small

“Digital transformation” often feels big and overwhelming. Before embarking on a mission to digitally overhaul the way an organization operates, it is important to go back to the basics. Clearly identify the goals you want to achieve and go after them in small steps. The most common goals revolve around improving customer experience, being more efficient through automation, and being nimbler to adapt to changes. There are two things companies should keep in mind: (a) start small and (b) don’t let perfect become the enemy of good. Many teams often get overwhelmed or burned out from trying to digitally transform their businesses all at once or from the top-down, versus starting small and incrementally improving their operations first.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for mortgage LO’s at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.