It’s easier to qualify to refinance

If you tried and failed to refinance in the past, 2019 might be your year to qualify to refinance.

Lenders are allowing higher debt-to-income ratios. Average credit scores for approved loans are falling. Down payments/equity are lower. All of these things are good if you plan to buy a home or refinance in 2019.

Why Lenders Are Relaxing Refinancing Guidelines

One reason that lenders are relaxing their guidelines is that mortgage lending has slowed down. Many homeowners have refinanced or purchased homes with favorable fixed rate loans. And now, interest rates are climbing — so there are fewer refinancing candidates. To stay in business, lenders have to keep loans coming in the door.

We won’t see the crazy lending that we did in the early 2000s, with no income or asset verification, terrible credit and no down payment. But if you “just missed” in 2018 or 2017, 2019 may be your year.

Mitigating Circumstances: How to Overcome Credit Challenges

Mitigating circumstances can offset credit blemishes if you choose to disclose them. For instance, if you went through bankruptcy following a devastating illness or a massive layoff by your company, that’s a situation over which you had no control. Once you have solved the problem (regained your health, secured another job), you may be eligible for financing.

Compensating factors are positives that you can use to bolster your file. For example, conservative use of credit, a regular savings habit, a new job or degree with great earning potential, and a housing expense that will drop after refinancing are all examples of compensating factors.

What does it take to qualify to refinance today?

Today, according to CoreLogic, one-fifth of all conforming (Fannie Mae or Freddie Mac) mortgages go to applicants whose debt-to-income ratio approaches 50 percent. And one in ten conventional (non-government) mortgages has a loan-to-value exceeding 95 percent. That’s in addition to the government mortgage programs allowing as little as zero down.

So you don’t need perfect credit or lots of money to get a mortgage. However, if you have little home equity (or a small down payment), and a high debt-to-income ratio and not-great credit, you won’t find it easy to get a conventional mortgage. Government-backed loans from the FHA, the VA or the USDA offer more flexible underwriting standards.

According to mortgage statisticians at Ellie Mae, the percentage of mortgage applications that close has been steadily increasing, and it stands today at 72.2 percent of all loans. About 4 percent of those loans went to applicants with FICO scores under 600. And while the average FICO for all closed loans is 727, for FHA loans, it’s just 660.

While it’s easier to get mortgage approval today, it still takes a top credit score to get the lowest mortgage rates. And you can save a ton by improving your credit.

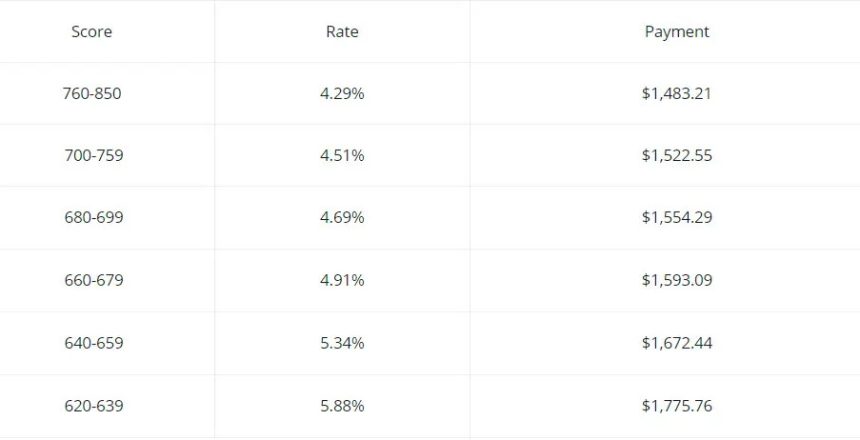

MyFICO.com has a handy calculator that tells you how your FICO score affects what you pay for various kinds of financing. As of this writing, here are the average mortgage rates people pay with different FICO scores, and how that affects the payment on a $300,000 mortgage:

An improving credit score can be a great reason to refinance. If your current mortgage was taken when you had a low credit score, and now your score has improved, you may save with a refinance today.