Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about The Mortgage Market Moves To Purchase. This week we’re bringing Mortgage Industry Trends:

Builder Confidence Falls to 13 Month Low*

Fears about construction costs, supply shortages, and concern over fast rising home prices acted to deflate builder confidence this month. The National Association of Home Builders (NAHB) says the NAHB/Wells Fargo Housing Market Index (HMI), a measure of its new home builders’ sentiment about the market for newly constructed homes, fell 5 points this month to 75, the lowest it has been since June 2020.

“While the demographics and interest for home buying remain solid, higher costs and material access issues have resulted in lower levels of home building and even put a hold on some ‘new home sales,” said NAHB Chief Economist Robert Dietz. “While these supply-side limitations are holding back the market, our expectation is that production bottlenecks should ease over the coming months and the market should return to more normal conditions.”

The HMI is derived from a survey NAHB conducts among its new home builder members. The survey, which has been conducted monthly for 35 years, asks for perceptions of current single-family home sales and sales expectations for those sales over the next six months as “good,” “fair” or “poor.” The survey also asks builders to rate traffic of prospective buyers as “high to very high,” “average” or “low to very low.” Scores for each component are then used to calculate a seasonally adjusted index where any number over 50 indicates that more builders view conditions as good than poor.

Rent Gains are Setting Records Too*

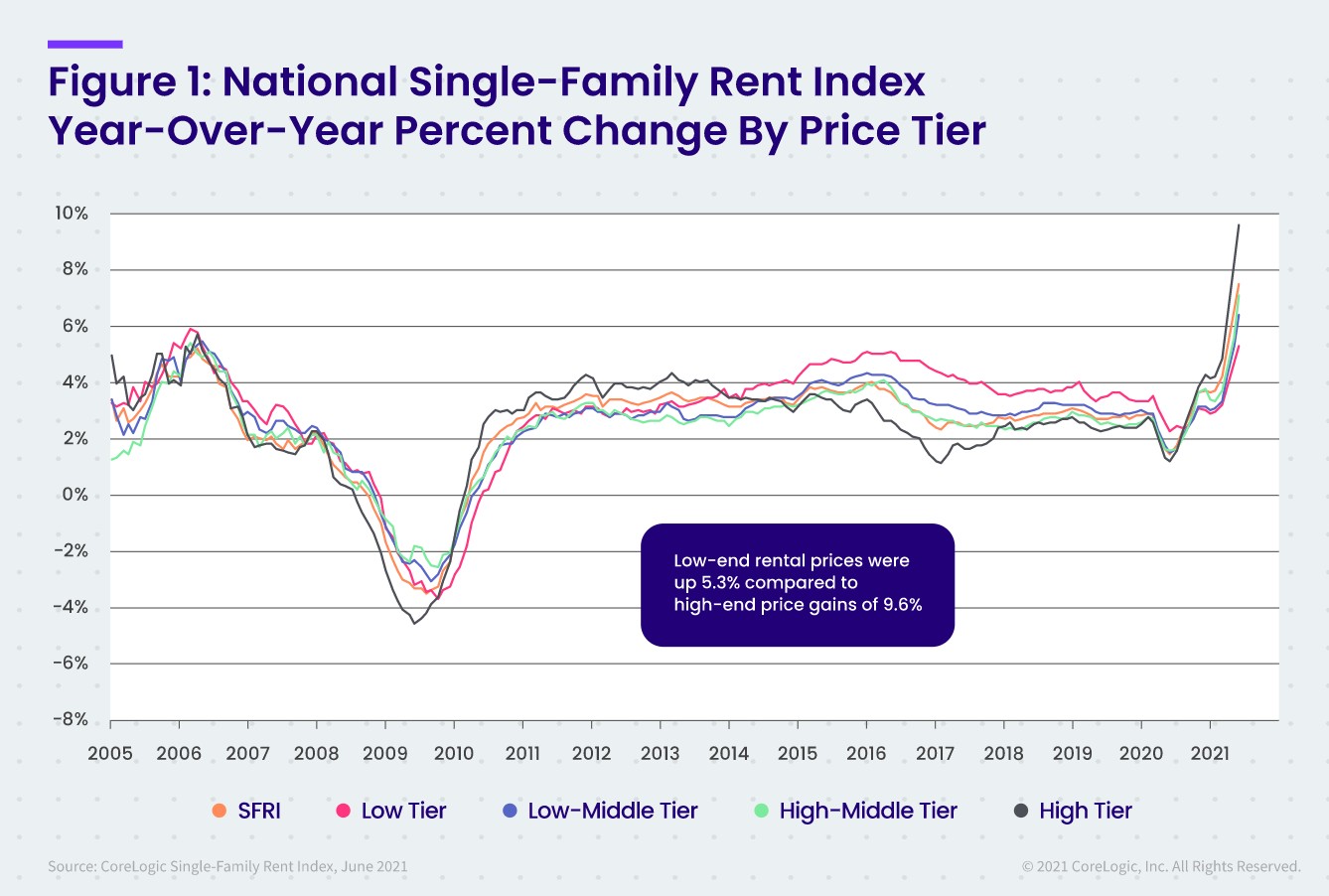

While home prices have been posting record increases for months, it appears that rents are trying to keep up. CoreLogic says the connection is clear. The company’s Single-Family Rent Index, which analyzes single-family rent price changes nationally and across major metropolitan areas, shows rent growth in June was the highest since at least 2005, an annual gain of 7.5 percent. The increase in June 2020 was 1.4 percent.

The company examines the path of single-family rents across four price tiers, and in each, the growth exceeded pre-pandemic rates for the third straight month. In the lower-priced tier of homes, those that rent for up to 75 percent of the regional median, rents increased 5.3 percent in June compared to 2.3 percent a year earlier.

The lower-middle tier, with rents from 75 to 100 percent of the median, saw an annual increase of 6.4 percent against only 1.5 percent in June 2020. Higher-middle priced rents, those in the 100 to 125 percent bracket, were up 7.1 percent, up from 1.5 percent the prior June. In the higher-priced tier, those single-families with rents more than 125 percent of the median, rents jumped 9.6 percent. The gain in June 2020 was 1.2 percent.

3 mortgage industry trends that will define the rest of 2021*

Three are still not enough houses to buy

For better or worse, trends in the mortgage industry tend to mirror corresponding trends in the overall real estate market. But there are definitely a few main things to looks out for — many of which are carrying over from a turbulent 2020 and early 2021 — when it comes to the upcoming landscape for the rest of 2021:

- Lack of inventory

- Fluctuating interest rates

- Increased adoption of technology

Inventory issues

Emerging out of the pandemic, the first half of 2021 showed that there is a historically low housing inventory across multiple markets in the U.S. Like so many other production pipelines, the construction of new homes, along with shortages in building materials like concrete and lumber, caused a significant decrease in new homes for purchase.

In addition, a vast majority of people spent more time at home in 2020 than ever before in modern history. As homes morphed into offices and schools over the last year, many people are looking to move, realizing they might want to start thinking about whether they need more space.

The subsequent lack of inventory, coupled with the high demand, has caused buyers to compete for properties, offering incentives and prices way above the asking price. Most buyers end up making multiple offers, working with brokers over more extended periods due to increased competition.

Typically, this dynamic tends to favor the seller because, thanks to the lower interest rates, buyers are willing to borrow more and pay less interest over the life of the loan. Low housing inventory and the general uncertainty in the economy all factor into the current market price for homes and interest rates.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for mortgage LO’s at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-323!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.