Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about Here’s Why Mortgage Rates Are Outperforming. This week we’re bringing you: Why is the housing market thriving in a pandemic?

Here’s how COVID-19 has transformed RON adoption*

Today’s Daily Download episode features an interview with Aaron Davis, CEO of Florida Agency Network, one of Florida’s largest RON providers. In this episode, HousingWire examines a recent article that delves into one key component that is hindering RON adoption. Davis discusses how RON adoption has changed in the era of COVID-19, what it will take for increased RON and eNote adoption in the secondary market and how RON has transformed the borrower experience overall.

Ramirez’s article is part of our HW+ premium membership community. When you go to sign up, use the code “hwpluspodcast100” to get $100 off your annual membership.

For some background on the story, here’s a summary of the article:

The Uncommonly Strong Case For Locking a Mortgage Rate*

Almost everywhere you look, low mortgage rates are in the news. Experts are claiming they’ll remain low or move lower for years to come. They might be right! But that doesn’t necessarily mean you should wait to refinance or to lock your rate if you’re already in the loan process.

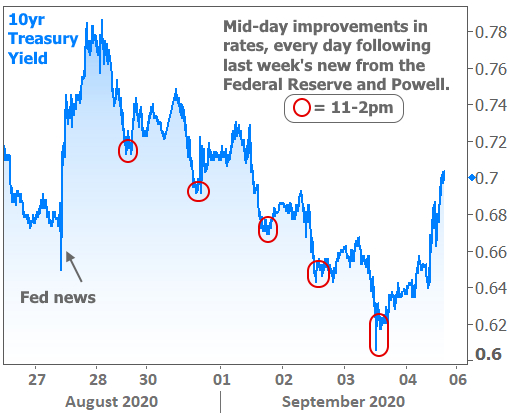

It is true that mortgage rates improved noticeably earlier this week. Part of the improvement is due to overall gains in the bond market following last week’s Federal Reserve scare. When the Fed updated its policy framework, the bond market was briefly spooked. A spooked bond market means higher yields/rates.

The next 5 business days brought a deliberate recovery for longer-term rates. This can be seen in the following chart of 10yr Treasury yields (a benchmark for all longer-term rates in the US). Definitely make a note of the bounce toward higher rates today, as that helps build the case for locking to some extent.

High home prices erase homebuyers’ increased purchasing power*

Low housing inventory is to blame

Homebuyer purchasing power increased 6.9% this July, meaning a homebuyer with a $2,500 monthly housing budget can afford a home priced $33,250 higher than a year ago, Redfin found, which it credited to historically low mortgage rates.

But with home prices up 8.2% year over year in July, this homebuyer purchasing power is essentially canceled out, data from Redfin shows.

“Low mortgage rates are motivating many people to purchase a home, particularly those who want more space to work from home,” Redfin Chief Economist Daryl Fairweather said in a release. “But because there hasn’t been an increase in the number of homes for sale since rates started dropping with the onset of the pandemic, many buyers end up competing for the same homes, driving up prices.”

For example: at a 3% mortgage rate, a homebuyer can afford a $516,500 home with a budget of $2,500 a month, up from a $483,250 home last year on the same budget. Essentially, the monthly payment on a $483,250 home has dropped from $2,500 a year ago to $2,339 today, Redfin said.

But because of low housing inventory, there are fewer homes for sale that are affordable for someone with a $2,500 monthly budget compared to last year. This July, only 70.6% of homes nationwide were affordable for a buyer with that budget, down from 71.9% last July.

Delinquency Rate Could Double Without More Federal Support*

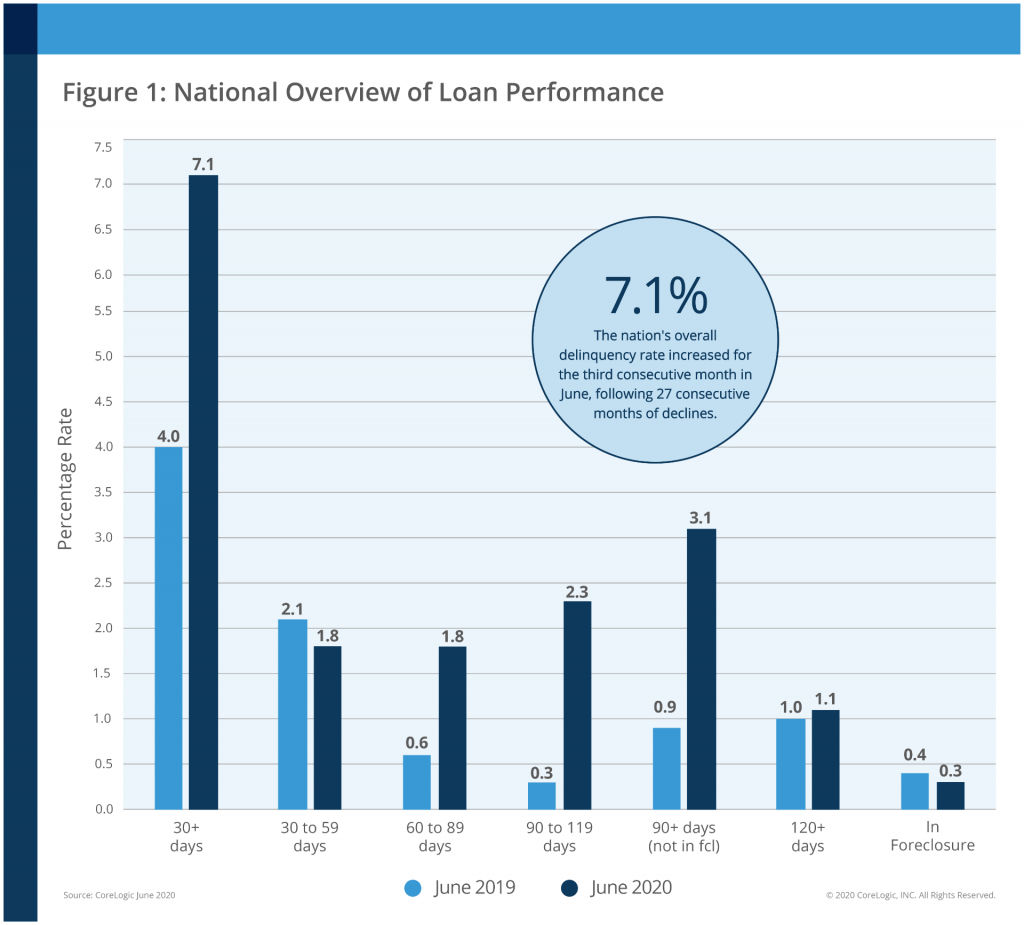

Mortgage delinquencies spiked in June and the serious delinquency rate, loans 90 or more days past due but not in foreclosure, reached its highest level in more than five years. CoreLogic in its monthly loan performance report, said 7.1 percent of all mortgages nationwide were at least 30 days past due, including those in foreclosure. This is 3.1 percentage points higher than the delinquency rate in June 2019.

Further, the company predicts that, barring additional government programs and support, serious delinquency rates could nearly double from the June 2020 level by early 2022. Not only could millions of families potentially lose their home, through a short sale or foreclosure, but this also could create downward pressure on home prices – and consequently home equity – as distressed sales are pushed back into the for-sale market.

Why is the housing market thriving in a pandemic?*

Low mortgage rates coupled with a shift to working at home are driving demand, Yun says

The deadliest pandemic in more than a century has failed to derail the housing market because of the lowest mortgage rates ever recorded coupled with a shift in how people use their homes.

“The buyers are coming in because of the low-interest rates – that’s the No. 1 reason,” said Lawrence Yun, chief economist of the National Association of Realtors said in an interview with HousingWire. “The secondary demand is coming from the work-at-home phenomenon that has people looking for bigger homes and caring less about commuting time.”

People now see their home not only as a place to live but as a shelter during a national health crisis, Yun said. It’s also an office and, for families with children, often a part-time school.

Mortgage rates began tumbling in mid-March after the Federal Reserve announced it would buy mortgage bonds and Treasuries to keep credit flowing amid the pandemic. It was similar to a fixed-asset program it created during the financial crisis a dozen years ago.

The average U.S. rate for a 30-year fixed mortgage has been under 3% since late July, as measured weekly by Freddie Mac. When Fed Chairman Jerome Powell announced in March the Fed would purchase bonds, it was 3.65%.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for mortgage LO’s at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.