Cash-out mortgage refinancing: Here’s where homeowners are using it most

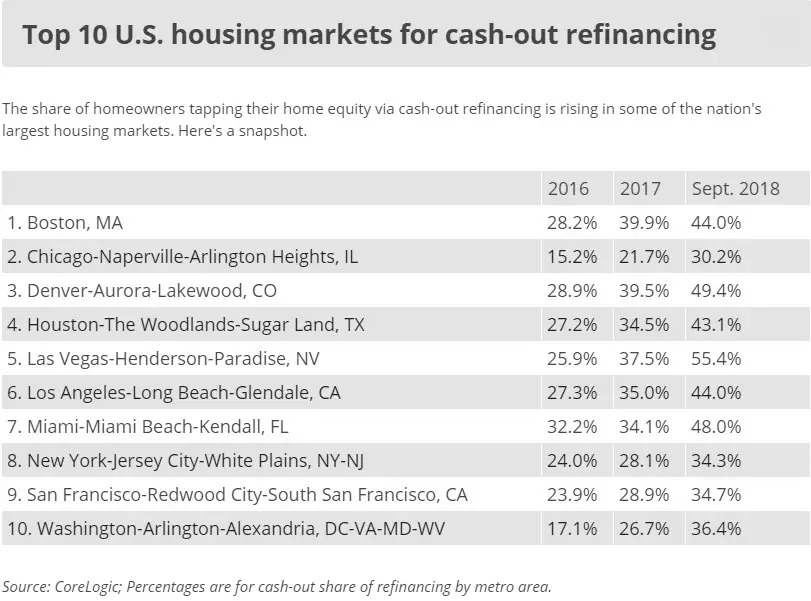

Homeowners who snagged a low-interest rate mortgage in recent years have a big incentive to avoid refinancing the loan because interest rates are higher now. When they need a large amount of cash, though, some homeowners are turning to cash-out refinancing — even if it means giving up a lower rate in the process. […]

Benefits of Refinancing | 5+ Top Benefits

Are you planning to refinance your mortgage? If so, it’s a great decision because there are a wide range of benefits you will get from doing so. There are times when it is advisable to do the refinancing, but you need to understand clearly all the financial objectives and keep them in mind. Here are […]

Making the Most of Cash-Out Refinancing

Cash-out refinancing accesses your home equity through a new mortgage with a bigger principal amount than the current one. You can avail for the difference amount between the principals of the two mortgages IN CASH for almost any purposes. Use cash-out refinancing option to obtain a new mortgage with a higher principal than your debt […]

Cash-Out Or Cash-In: Which Refinance Should You Get?

Mortgage rates went up marginally during the last few months. Still, rates are low enough to consider refinancing. Rates may go up in the coming months, so if you are planning to refinance now is the time to submit your application. When you refinance, basically you have got three options. Most borrowers refinance for the […]

Should You Refinance?

Refinancing is not a decision to take lightly. If you are asking yourself if you should refinance, the answer is not as simple as a “yes” or a “no.” You should refinance depending on several factors, and before you start the process, you need to know if refinancing is right for your particular situation. It’s […]