Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about How One Lender Is Tackling Demand For Jumbo Loans In 2021. This week we’re bringing Prepare For The Rise In Mortgage Rates:

Three reasons there won’t be a 2021 housing market crash*

Housing bubble boys should take the year off

2020 came, and with it COVID-19. Five weeks into the crisis, demand in the U.S. housing market bottomed and then after about nine weeks, began to climb again, with purchase applications making a full V-shaped recovery by early June. The housing bubble boys had those five glorious weeks when it finally looked like the market would succumb to their dire predictions of a housing crash. That is not much time to hawk a book, website, newsletter or what-have-you, but I guess one has to make hay where the sun don’t shine – or however that goes.

Now, in the first weeks of 2021, it’s like de ja vu all over again. Our friendly neighborhood bubble boys are hawking a 2021 housing crash, citing as evidence the moderation of some housing data metrics that inevitably follow parabolic increases. But they see these moderations back to trend as the harbingers of a housing crash that will send home prices back to 1996 levels in a short time.

Remember, all housing bubble boys have to believe that prices go back to the start of the original bubble, hence the marketing of housing bubble 2.0.

Fannie Mae increases 2021 economic growth forecast*

But GSEs predict housing activity will slow

Fannie Mae‘s latest forecast projects economic growth to hit 5.3% in 2021, an increase of 0.8 percentage points from what the government-sponsored enterprise projected last month.

The forecasted growth is significantly more than the revised numbers for 2020, which Fannie Mae projects will end up as a 2.7% contraction. The company said the economy will see an especially strong uptick in the spring months, with the expansion of COVID-19 vaccination efforts and the warmer weather.

“COVID-19 remains the dominant force altering the path of the economy through the behaviors of people, businesses and policy makers,” said Doug Duncan, Fannie Mae senior vice president and chief economist. “Therefore, the best policy for economic recovery is the broad distribution of an effective vaccine, which is underway. The sooner this can be successfully accomplished the sooner growth can accelerate, and our thought is that by mid-year vaccine distribution efforts will be well-established, allowing for a strong second half.”

But even as overall economic growth accelerates, Fannie Mae said housing growth could slow over the next year. The company’s Economic and Strategic Research Group expects home sales to rise by 3.8% in 2021, with the monthly pace slowing throughout the year. Purchase mortgage originations are expected to rise to $1.8 trillion in 2021, up from the projected $1.6 trillion in 2020, while refinance originations could reach $2.2 trillion in 2021, down from a projected all-time high of $2.8 trillion in 2020.

“Our latest forecast projects that the continued waning of pent-up demand from last year’s delayed spring homebuying season, coupled with a modest rise in interest rates, will likely slow the pace of housing, measured both by the volume of mortgages refinanced and by the pace of home sales,” Duncan said. “However, in our view, a modest slowdown in the sales pace is unlikely to prevent year-end 2021 home sales from being higher than 2020.”

Freddie Sees Mortgage Originations Contracting Nearly 20% in 2021*

Freddie Mac’s first quarter 2021 economic forecast is unusually short, and, unlike recent forecasts from either of the GSEs, has relatively few revisions. The company’s economists say that nearly a year after the first cases of COVID-19 were diagnosed in the U.S., economic growth remains uncertain, with answers largely hinging on the roll-out of the new vaccines. The labor market remains weak with close to 20 million collecting unemployment insurance. December’s job losses, the first since last April, didn’t change the unemployment rate from 6.7 percent because labor participation also declined.

Record low mortgage rates continued to carry the housing market during the turmoil of the pandemic. At the end of the first week of 2021, the 30-year rate hit 2.65 percent, a new low. Freddie Mac expects the low interest rate environment to continue through both this year and next, averaging 2.9 percent through this end of this year and 3.2 percent in 2022.

Along with the low rates, the demand for housing has also been supported by the ability of workers to do so remotely. Sales in 2020 reached levels last seen in 2006. Annualized sales hit 7.6 million in the fourth quarter with strong showings from both new and existing home sales. Freddie Mac forecasts total home sales to be 6.8 million in the first quarter of 2021 and to average 6.5 million for the full year.

Continued Gains for November Single-Family Permits*

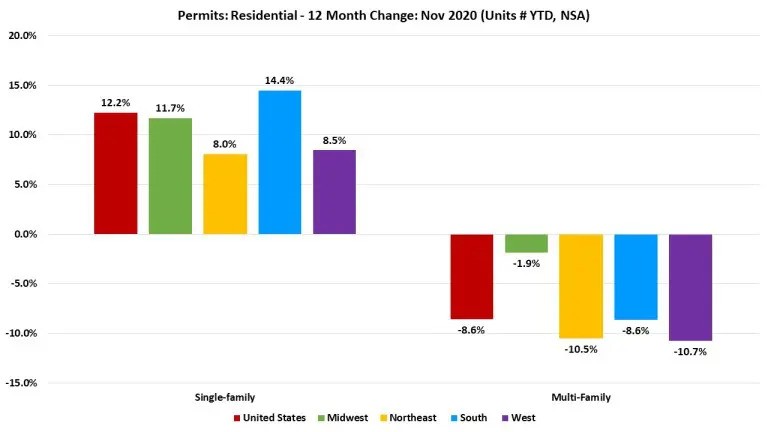

Over the first eleven months of 2020, total single-family permits issued year-to-date (YTD) nationwide reached 888,217. On a year-over-year (YoY) basis, this is an 12.2% increase over the November 2019 level of 791,452.

Year-to-date ending in November, single-family permits across the four regions ranged from an increase of 14.4% in the South to an increase of 8.0% in the Northeast. In multifamily permits, all four regions reported declines; West (-10.7%), Northeast (-10.5%), South (-8.6%), and the Midwest (-1.9%).

Between November 2019 YTD and November 2020 YTD, 45 states saw growth in single-family permits issued while five states and the District of Columbia registered a decline. Vermont recorded the highest growth rate during this time at 37.8% from 865 to 1,192 while single-family permits in the District of Columbia declined by 19.6%, from 163 in 2019 to 131 in 2020. The 10 states issuing the highest number of single-family permits combined accounted for 61.3% of the total single-family permits issued.

Prepare for the rise in mortgage rates*

Economists weigh in on how a modest rise in rates will play out in 2021

As the calendar flipped to 2021, it didn’t take long for the rise in mortgage rates. Just two weeks into the new year, Freddie Mac reported that mortgage rates climbed 14 basis points to 2.79%, a dramatic contrast to 2020, a year in which mortgage rates set record lows 16 times.

Economists across the housing industry believe the era of extreme low rates could be coming to a close, but the transition might be a slow burn.

Freddie Mac’s quarterly forecast estimates that the average 30-year fixed-rate mortgage will be 2.9% in 2021 and 3.2% in 2022. However, the factors that will drive mortgage rate movements are still up for debate.

HousingWire spoke to several economists in the housing industry to get their take on how high mortgage rates will climb in 2021, how lenders will respond, and what impact this will have on the housing market.

What the Fed giveth, can also taketh away.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for mortgage LO’s at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.