REVIVE

Revive the Mortgage

Loan Opportunities

Hidden in Your CRM

If a mortgage lead didn’t fund. It doesn’t mean it’s dead. Revive knows which CRM leads to work. Now you can too.

OF LEADS DON’T FUND WITH THE LENDER THEY WERE ORIGINALLY SOLD

OF SELF ASSESSED

BOGUS LEADS ARE ACTUALLY GOOD

OF ALL LEADS

FUND AFTER

120+ DAYS

REVIVE

Revive the Mortgage

Loan Opportunities

Hidden in Your CRM

If a mortgage lead didn’t fund. It doesn’t mean it’s dead. Revive knows which CRM leads to work. Now you can too.

OF LEADS DON’T FUND WITH THE LENDER THEY WERE ORIGINALLY SOLD

OF SELF ASSESSED

BOGUS LEADS ARE ACTUALLY GOOD

OF ALL LEADS

FUND AFTER

120+ DAYS

BRING CRM MORTGAGE LEADS

BACK TO LIFE

Leveraging the data in your CRM, matched with the Revive Al-driven property, title,

mortgage, valuation, and loan suggestion engine, you’ll gain the power to…

Spot In Market Borrowers

Revive identifies borrowers in your CRM likely to still be in market looking for a loan that you can provide

Identify Best Fit Loans

Revive’s AI loan suggestion engine identifies the loan options to best fit the lead’s profile

Win With Data

Revive verifies and appends every lead in your CRM with 270+ data elements. You’ll know which leads to work now

BRING CRM MORTGAGE LEADS

BACK TO LIFE

Leveraging the data in your CRM, matched with the Revive Al-driven property, title, mortgage, valuation, and loan suggestion engine, you’ll gain the power to…

Spot In Market Borrowers

Revive identifies borrowers in your CRM likely to still be in market looking for a loan that you can provide

Identify Best Fit Loans

Revive’s AI loan suggestion engine identifies the loan options to best fit

the lead’s profile

Win With Data

Revive verifies and appends every lead in your CRM with 270+ data elements. You’ll know which leads to work now

LEVERAGE NATIONWIDE PROPERTY

AND FINANCIAL DATA TO ENHANCE

THE LEADS EXISTING IN YOUR CRM

LEVERAGE NATIONWIDE PROPERTY

AND FINANCIAL DATA TO ENHANCE THE LEADS EXISTING IN YOUR CRM

REAL ESTATE INSIGHT

NOW EXISTS IN YOUR CRM

Leveraging lending-based property data that spans over 99% of U.S. homeowners, Revive analyzes

the underlying home associated with each lead to identify if the lead is still an open opportunity.

- Title Holder

- Interest Rate

- Loan Status

- Sales History

- Sale Price

- AVM Value

- Current LTV

- Property Characteristics

- Liens & Lien History

- Originating Lender

REAL ESTATE INSIGHT

NOW EXISTS IN YOUR CRM

Leveraging lending-based property data that spans over 99% of U.S. homeowners, Revive analyzes the underlying home associated with each lead to identify if the lead is still an open opportunity.

- Title Holder

- Interest Rate

- Loan Status

- Sales History

- Sale Price

- AVM Value

- Current LTV

- Property Characteristics

- Liens & Lien History

- Originating Lender

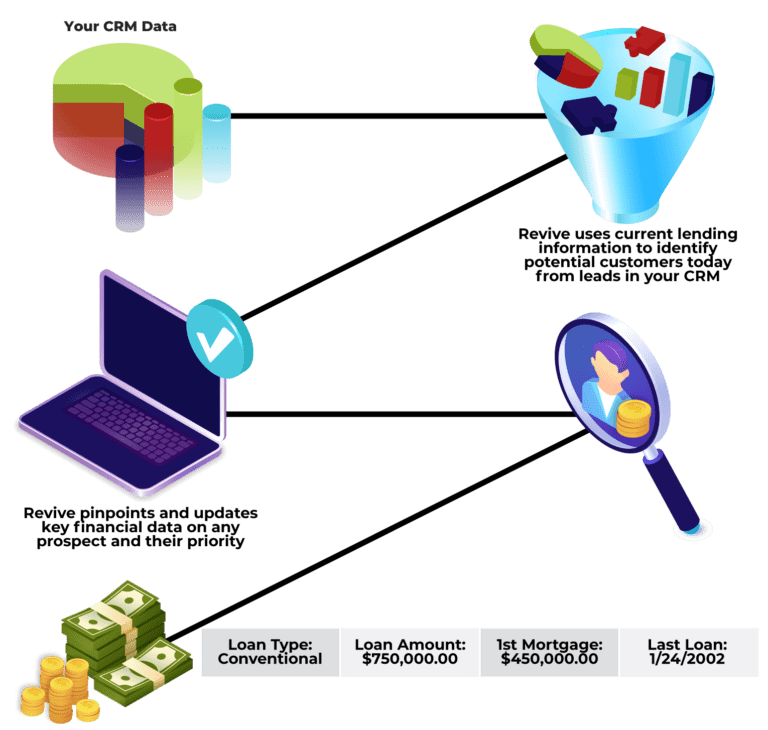

FAQs

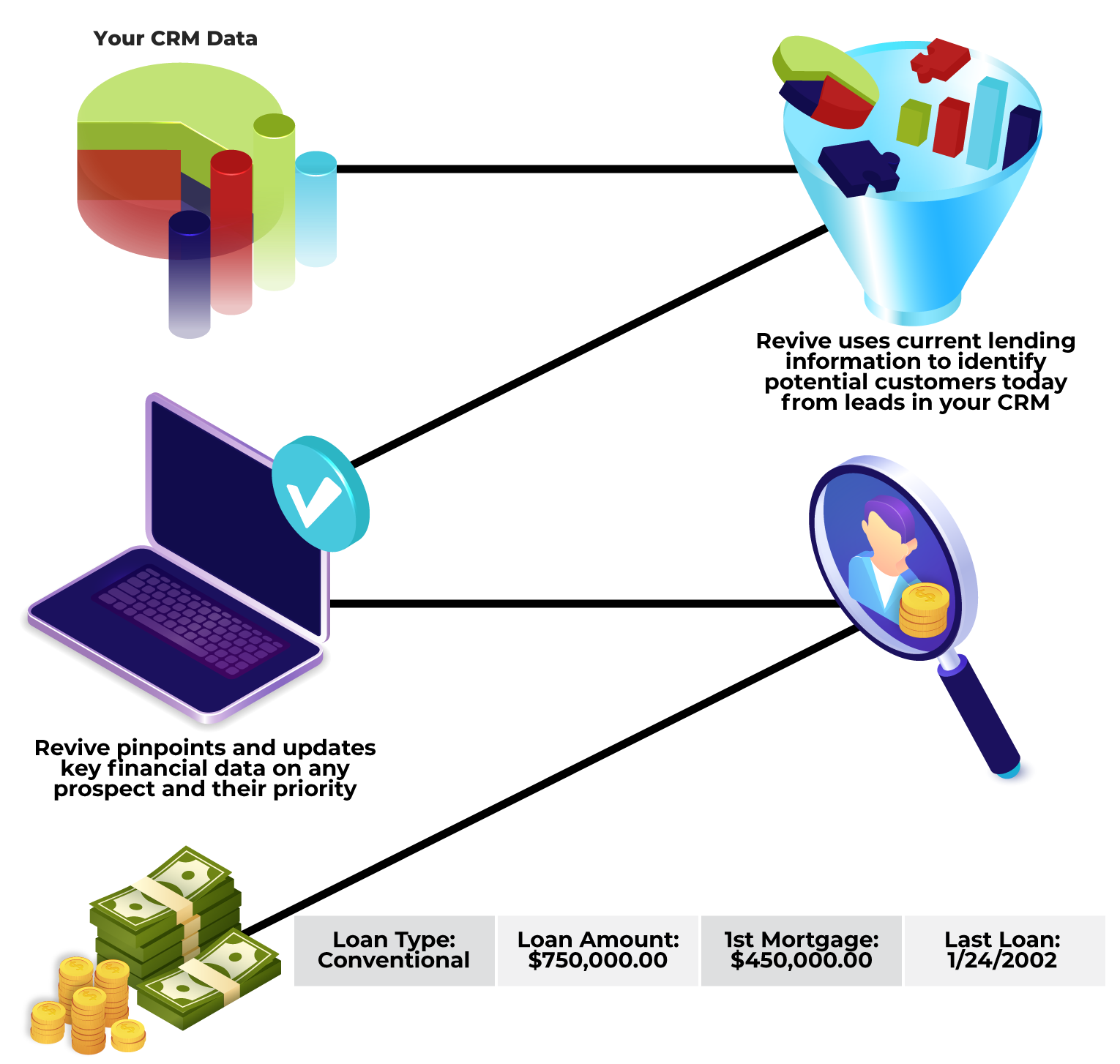

HOW REVIVE FINDS

OPPORTUNITIES IN YOUR CRM

Learn how Revive analyzes and enhances your existing customer/lead database

with hundreds of data elements about the current state of your customer.

Revive uses current lending conditions / programs to identify potential customers today from leads or clients that are already in your CRM.

Revive quickly pinpoints and updates key financial data on any prospect and their property with key intel such as loan type, amount and more.

You’ve made a significant investment in customer acquisition. Revive helps you get the most out of your investment by identifying the highest potential leads.

Revive is run on a batch process. Simply provide your CRM data and Revive’s AI Loan validation engine will match and append over 270 financial and property data points.

Revive uses a unique data set that can eliminate bad leads / fraud before lender acceptance

Revive allows lenders to accept or reject leads based on:

- Title

- Current Lender

- Lien date(s)

- Loan balance(s)

FAQs

HOW REVIVE FINDS

OPPORTUNITIES IN YOUR CRM

Learn how Revive analyzes and enhances your existing customer/lead database

with hundreds of data elements about the current state of your customer.

Revive uses current lending conditions / programs to identify potential customers today from leads or clients that are already in your CRM.

Revive quickly pinpoints and updates key financial data on any prospect and their property with key intel such as loan type, amount and more.

You’ve made a significant investment in customer acquisition. Revive helps you get the most out of your investment by identifying the highest potential leads.

Revive is run on a batch process. Simply provide your CRM data and Revive’s AI Loan validation engine will match and append over 270 financial and property data points.

Revive uses a unique data set that can eliminate bad leads / fraud before lender acceptance

Revive allows lenders to accept or reject leads based on:

- Title

- Current Lender

- Lien date(s)

- Loan balance(s)

Discover The Loan Opportunities In Your CRM

Mortgage lenders who convert the most leads, use Revive. Watch the video to see why.

- Banking level property, lien, and valuation data

- Instant appending of missing data

- Save time and effort. Focus on the leads most likely to fund

Discover The Loan Opportunities In Your CRM

Mortgage lenders who convert the most leads, use Revive. Watch the video to see why.

- Banking level property, lien, and valuation data

- Instant appending of missing data

- Save time and effort. Focus on the leads most likely to fund

REQUEST MORE INFORMATION

Bring Your Mortgage Leads Back To Life

Revive will show you the exact leads in your CRM to work now. Revive knows.

Now you can too. Just complete this form to learn more.

877-245-3237

inquiries@ileads.com

567 San Nicolas Drive Suite 180 Newport Beach CA 92660

REQUEST MORE INFORMATION

Reach the Right Customers Every Time

877-245-3237

inquiries@ileads.com

567 San Nicolas Drive Suite 180 Newport Beach CA 92660

SATISFIED CLIENTS

Empowering Lead Generation Since 1996