Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about Will We Have A Buyer’s Housing Market in 2021?. This week we’re bringing you: How One Lender Is Tackling Demand For Jumbo Loans In 2021

What bonds are telling us about the housing market*

Even with the drama of the past week, the markets didn’t blink

Think of the markets as capitalist soothsayers. They do not abide by partisan politics, social mores or ethics. They do not care who is president. The markets react to what has the potential to make money for companies, good or bad, and what has the potential to prevent companies from making money. Also, whether they believe there will be economic and housing market growth.

This is why even though we have suffered great drama in the past week, the markets didn’t blink. Consider:

Hospitalizations due to COVID-19 are at seven-day average record highs;

COVID-19 deaths are at seven-day average record highs;

The U.S. capital was under siege while congressional members were in chambers;

And the U.S. jobs report was negative 140,000 jobs for the first time since April.

It’s been a bumpy (horrendous) start to the year, but the markets see sunny days ahead. In the same week that we experienced a real-life horror show, the 10-year not only broke over 1% for the first time since the beginning of COVID, but also ended the week with much higher yields!

My “America is Back” economic and housing market model needed the 10-year yield to get to 1% in 2020, and we got as high as 0.99% before the year ended. What happened with the 10-year yield last week was a material change in the market and one that I believe is an accurate indicator of better economic times ahead.

Tentative Recovery in Mortgage Availability With Help From Government and Jumbo Loans*

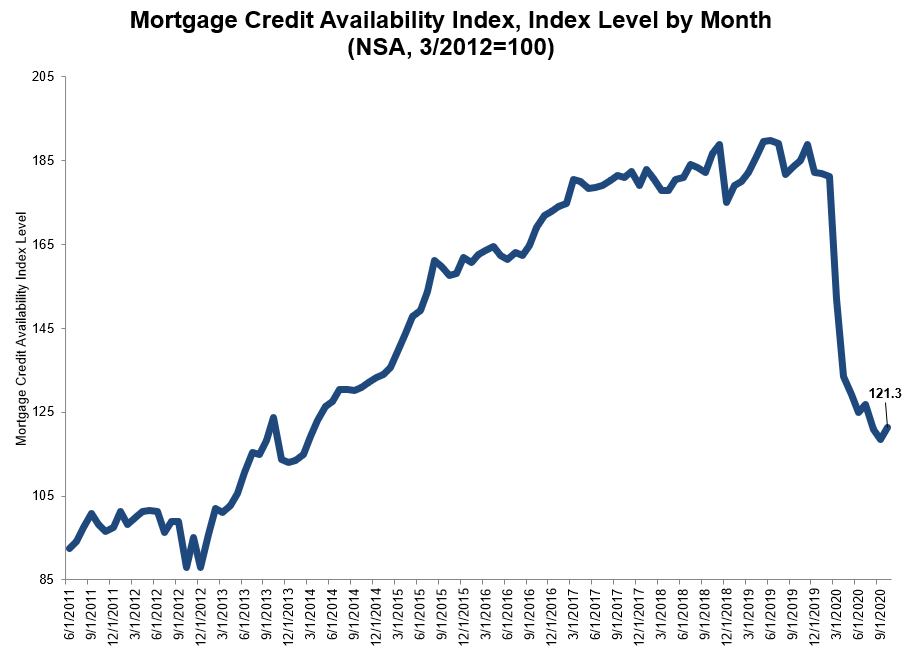

While it did dip a bit last month, the availability of mortgage credit appears to be stabilizing, having moved only slightly over the last three months. The Mortgage Bankers Association’s (MBA’s) Mortgage Credit Availability Index (MCAI) was down 0.1 percent in December, to a reading of 122.1. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit.

The MCAI was at 181.3 in February 2020 as news of the pandemic broke. It declined by 16.1 percent in March and another 12.2 percent in April. Subsequent smaller decreases ultimately took the index to 118.6 in September before it began what is so far a hesitant recovery.

The index has four components based on loan types. The Conventional MCAI decreased 2.8 percent in December while the Government MCAI increased by 2.1 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.4 percent, and the Conforming MCAI fell by 7.2 percent.

Forbearance rate falls to mid-April levels*

However, there have now been eleven consecutive weeks forbearance portfolio share has hovered between 5 and 6%

The U.S. forbearance rate fell seven basis points last week to 5.46% of servicer’s portfolio volume, according to a survey from the Mortgage Bankers Association on Monday. As of last week’s data set, forbearance portfolio share is now below numbers Black Knight reported in mid-April of 2020.

Every investor class managed to see a decline in rate, with Fannie Mae and Freddie Mac once again claiming the smallest forbearance rate at 3.19%.

Ginnie Mae loans in forbearance, which include loans backed by the Federal Housing Administration, have fluctuated greatly in the past several months and fell seven basis points to 7.85%. Although portfolio loans and private-label securities (PLS) experienced the greatest decline after a 10 basis point drop, they still held the largest rate at 8.77%.

Overall, forbearances are decreasing, but the speed at which they are declining is beginning to slow. Last week marked the eleventh consecutive week servicers portfolios have hovered between 5% and 6% – the longest a percentage range has held since the survey’s origins in May.

While it arrives as positive news that forbearances are once again descending, economists worry that the length at which borrowers remain in forbearance may become troublesome.

“The data show that those homeowners who remain in forbearance are more likely to be in distress, with fewer continuing to make any payments and fewer exiting forbearance each month,” said Mike Fratantoni, MBA’s senior vice president and chief economist.

How one lender is tackling demand for jumbo loans in 2021*

Acra Lending remains committed to supporting borrowers’ needs across the market

Following its rebrand from Citadel Servicing Corp. to Acra Lending, the company has also launched a new jumbo prime program. HousingWire recently spoke with Keith Lind, Acra executive chairman and president, and Acra CEO Kyle Gunderlock, about the new program and how it will help borrowers in 2021 and beyond.

HousingWire: Why did you develop the Jumbo Prime program?

Keith Lind: This specific program has been developed to meet the needs of customers in today’s environment. We wanted to introduce a program that provides borrowers with the larger loan amounts they need to purchase or refinance a high-value property. We have been working non-stop to provide programs through our retail, wholesale and correspondent channels, which have significant demand in the marketplace.

Kyle Gunderlock: The addition of this program demonstrates our commitment in identifying, responding to and anticipating the needs of borrowers across the market. We have always set high standards and our team works diligently on a daily basis to continue to maintain responsible lending practices as the foundation of our business.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for mortgage LO’s at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.