Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about It’s Official: The U.S. Won’t See A Housing Bubble Crash Anytime Soon. This week we’re bringing you: U.S. Homeownership Rate Soars To An Almost 12-Year High

Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about It’s Official: The U.S. Won’t See A Housing Bubble Crash Anytime Soon. This week we’re bringing you: U.S. Homeownership Rate Soars To An Almost 12-Year High

Loans in forbearance fall for the sixth straight week*

Though the pace of borrowers exiting forbearance slowed

The total number of loans in forbearance fell for the sixth week in a row to 7.74% of servicers’ portfolio volume, according to a report by the Mortgage Bankers Association. As the country braces for the end of moratoriums and unemployment benefits under the CARES Act, the MBA estimates 3.9 million homeowners are in forbearance plans.

The share of mortgages in forbearance backed by Fannie Mae and Freddie Mac dropped for the seventh week in a row to 5.59% – another three-month low for the GSE’s.

According to the report, the pace of borrowers exiting forbearance slowed last week as homeowners wait for deliberation of the HEROES Act, which would grant a 60-day mortgage forbearance automatically if their mortgage became 60 days delinquent between March 13 and the day the bill was enacted.

Despite falling 30 basis points the week prior, Ginnie Mae securities – mortgages backed by the Federal Housing Administration, the Veterans Administration, and the U.S. Department of Agriculture – rose slightly by 1 basis point last week to 10.27%. Read more in-depth here.

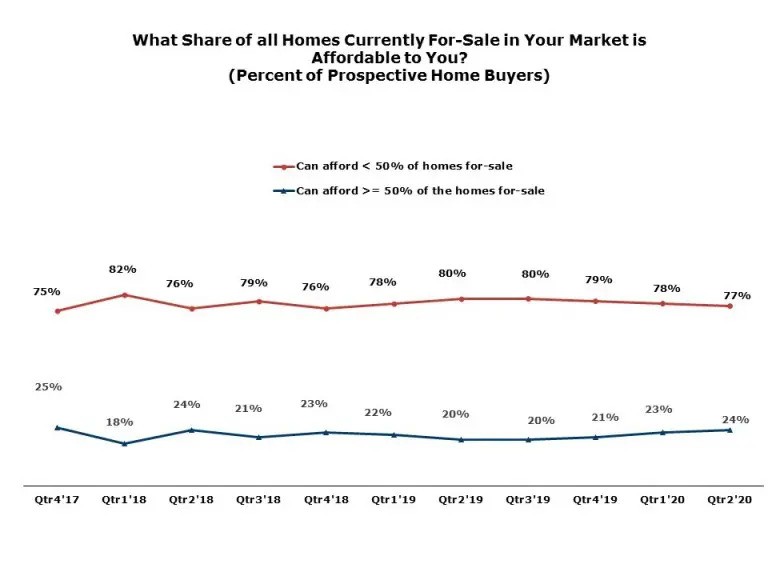

Housing Affordability is Still a Challenge, but Improving*

The National Association of Home Builders’ (NAHB’) Housing Trends Report for the second quarter of 2020 found slightly less than a quarter of prospective homebuyers could afford a median-priced home in their local markets, leaving 77 percent shut out. However, Rose Quint, writing in NAHB’s Eye on Housing blog, calls that an improvement from a year ago when only 20 percent could buy. She says that lower interest rates are responsible for the change.

Jumbo Mortgage Rates Are No Longer the Cheapest Mortgages Around*

Record-low interest rates are helping home buyers lock in years of savings on future mortgage payments. But those searching for larger homes or inexpensive markets aren’t reaping the same rewards.

The average rate on a 30-year jumbo mortgage was 3.77% in mid-July, more than 0.4 percentage point above the average rate on smaller, conforming loans, according to Bankrate.com, a personal-finance website. From mid-2015 until this spring, jumbo rates had been consistently lower than or equal to the rates on conforming loans.

The reversal is just one of the ways the coronavirus crisis has wreaked havoc on the mortgage market. The same force pushing most mortgage rates to record lows—investors piling into safe-haven assets like government bonds—has pushed jumbo loans out of favor. Read more in-depth here.

MBS RECAP: Nice Recovery But Resistance Remains*

Rates were under pressure overnight with 10yr hitting the highest yields in more than 2 weeks. Since then, bonds have surged back into the stronger territory but remain more or less blocked by the same old floor.

Econ Data / Events

- 20min of Fed 30yr UMBS Buying 10 am, 1130am (M-F) and 1 pm (T-Th)

- Consumer Confidence 92.6 vs 94.5 f’cast, 98.3 prev

U.S. homeownership rate soars to an almost 12-year high*

Change in data-collection methods because of COVID-19 may have influenced results, Census Bureau says

The U.S. homeownership rate soared to an almost 12-year high in the second quarter as low-interest rates allowed more Americans to qualify for mortgages.

The homeownership rate jumped to 67.9%, the highest since 2008’s third quarter, from 65.3% in the prior quarter, the Census Bureau said on Tuesday. The reported noted a change in methodology that could have impacted the numbers: Because of the COVID-19 pandemic, in-person interviews were suspended and most of the survey was conducted by telephone, the release said.

The homeownership rate for Black Americans rose to 47%, the highest since 2008, from 44%, the report said. A year ago, the rate for Black families was the lowest ever recorded.

The rate for Hispanics increased to 51.4%, the highest in data going back to 1994, from 48.9%, the Census report said. Read more in-depth here.

Featured iLeads Solution:

Looking for the most qualified leads? iLeads credit-based leads might be the answer. Learn more…

We are ready to help you navigate through the COVID-19 mortgage environment.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for mortgage LO’s at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7 AM to 5 PM PST, Monday through Friday.

You can also schedule a call here.