Welcome to iLeads Insurance Market Minute, where we bring you the latest, most relevant news regarding the insurance market. Last week you were reading Coronavirus Raises Fears Of Increase In Insurance Fraud. This week we’re bringing you:Revealed – What Will Happen To Insurance Industry Employment In The Next 12 Months.

Welcome to iLeads Insurance Market Minute, where we bring you the latest, most relevant news regarding the insurance market. Last week you were reading Coronavirus Raises Fears Of Increase In Insurance Fraud. This week we’re bringing you:Revealed – What Will Happen To Insurance Industry Employment In The Next 12 Months.

Insurers face difficult choices with marijuana*

The workers compensation industry anticipated that marijuana would be a hot legislative topic in 2020 for both recreational and medicinal use. However, when the pandemic hit, attention shifted to the public health crisis surrounding COVID-19.

The drug’s current status as an illegal Schedule I drug according to the U.S. Food and Drug Administration, the lack of large-scale studies on marijuana, and questions on dosing and efficacy are outstanding issues that may keep the drug a questionable option for treating injured workers.

Prior to the pandemic, “quite a few states either had case law or updated their regulatory framework around marijuana reimbursement to injured workers, but of course there has not been a change in federal law … so that really continues to be a barrier,” said Sandy Shtab, Tampa, Florida-based assistant vice president of advocacy and compliance for Healthesystems LLC.

That dichotomy continues to place insurers in a difficult position — particularly in states that have mandated its reimbursement either legislatively or in the courts — of following their state rules or abiding by federal law.

Workers compensation presumption laws challenge employers*

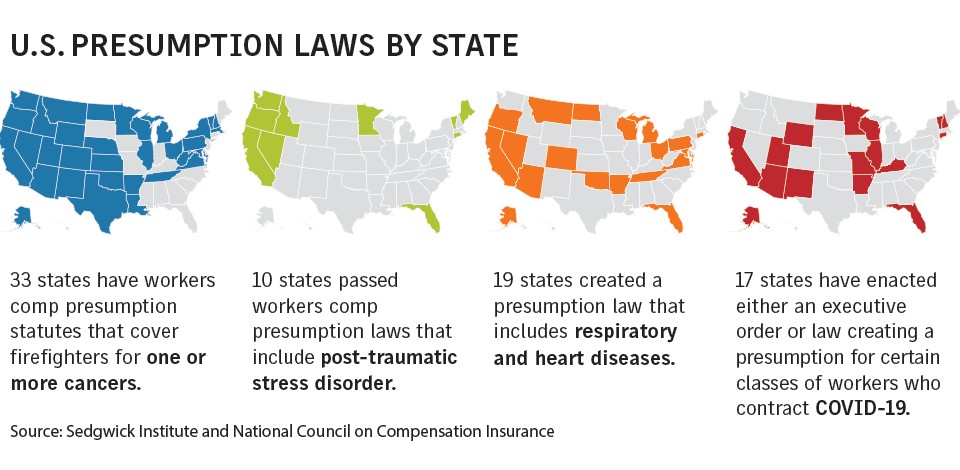

Workers compensation presumption laws, which place the burden on employers to prove that an injury or illness was not picked up on the job, have increased as states seek to expand benefits for first responders with cancer and mental health issues.

The trend has accelerated during the COVID-19 pandemic as lawmakers seek to protect health care workers and others exposed to the disease through their employment.

But the addition of presumption laws for essential workers has raised concerns over how far the workers comp expansions may go and whether insurers and employers are prepared to deal with the associated expenses, which include legal costs as most presumption laws are “rebuttable,” meaning if an employer can prove the ailment was unrelated to work it can fight it in court.

WIA swoops for New York agency*

World Insurance Associates has announced the acquisition of Jefferson Valley, N.Y.-based Countywide Insurance Agency. Terms of the transaction were not disclosed.

“We’re committed to developing and nurturing long-term relationships with our clients and carriers,” said Richard Strauss, who has joined WIA as manager of the Countywide Insurance Agency unit. “Our partnership with World Insurance Associates allows us to do so with the backing and resources of a nationally recognized company.”

Revealed – what will happen to insurance industry employment in the next 12 months*

A new report from The Jacobson Group and Aon has found that the insurance industry is set for slow, but steady employment growth over the next 12 months.

Jacobson and Aon’s semi-annual Insurance Labor Market study revealed that insurers plan to maintain or increase hiring as 2020 continues – 83% of companies surveyed said that they plan to maintain or increase staff during the next year.

However, that growth will not come easy, as insurers also indicated that they expect the difficulty in recruiting new employees to persist – despite industry unemployment being somewhere around 4.8%, the study noted.

Key findings of the study included:

- Forty-eight per cent (48%) of insurance companies said they plan to increase staff during the next 12 months – with the personal lines P&C segment comprising 60% of those companies with employment plans.

- Seventeen per cent (17%) are planning to decrease the number of employees – the highest total reported since January 2012, and the third highest total since 2009.

- Fifty per cent (50%) of medium-sized companies plan to add staff during the next 12 months.

- The primary reason to increase staff during the next 12 months is the anticipated increase in business volume, followed by business areas being understaffed. Forty-five per cent (45%) of companies indicated these as the primary reasons for hiring.

Featured iLeads Solution:

Looking for the most qualified leads? iLeads insurance leads might be the answer. Learn more…

We are ready to help you navigate through the COVID-19 insurance environment.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for insurance agents at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.