Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about Refis Lead The Way As Mortgage Applications Rise 1.7%. This week we’re bringing you:

Beware of gloom and doom housing market headlines*

Here’s the data to watch to know when housing is in trouble

With Halloween in the rearview mirror, we still have one more spook to survive in 2020 – and no, I’m not talking about the upcoming election. I’m talking about housing market crash headlines.

The housing data has been wild this year. We’ve seen waterfall declines and parabolic rebounds. These dramatic peaks and valleys have fed the demons of greed and fear that infest the minds of our extreme housing bulls and housing market bears – leading to equally wild speculations about the future of U.S. housing.

With all these dramatic people espousing their housing market takes, how is a reasonable person to know what to believe?

Fortunately, there is a way to stay sane. Following some fundamental housing data trends will keep you on the straight and narrow path of reality and immunize you against the outlandish flights of fancy put forward by our extremist friends.

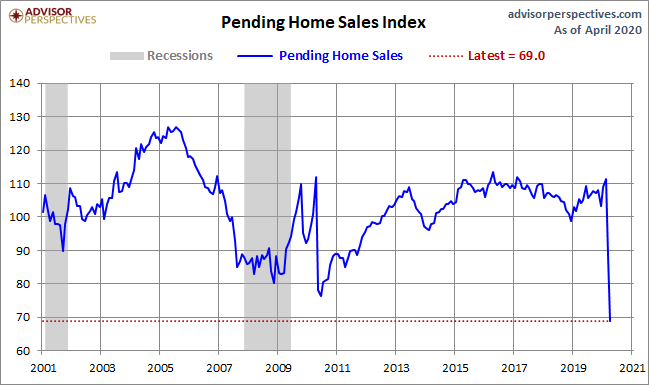

Take the Pending Home Sales Index, for example. In April of this year, pending home sales had its worst print of the 21st century.

Think Tank Concludes Mortgage Guidelines Could Safely be Twice as Risky*

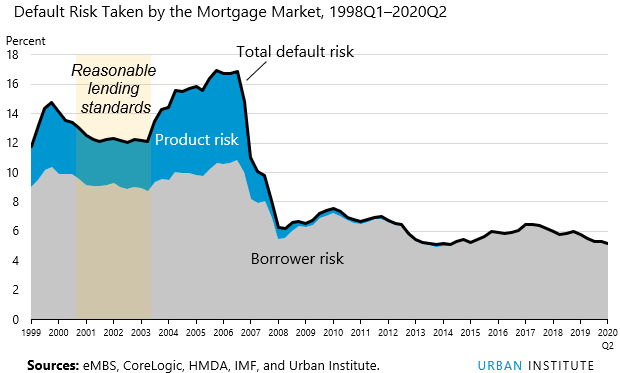

The Urban Institute’s (UI’s) Housing Finance Policy Center has updated its credit availability index (HCAI) to reflect data for the second quarter of 2020. The Index shows a slight dip from an adjusted 5.3 percent in the first quarter to 5.2 percent in the second quarter. Tightening in the GSE and government channels has driven a retraction of credit availability through the first half of 2020, as the risk in the portfolio and private-label securitization market remains a shadow of what it once was.

The HCAI measures the percentage of owner-occupied home purchase loans that are likely to default-that is, go unpaid for more than 90 days past their due date. When the HCAI declines it indicates the lenders have a greater unwillingness to tolerate defaults and they are imposing tighter lending standards, making it harder to get a loan. A higher HCAI indicates a higher tolerance for defaults and that lenders are taking more risks, making it easier to get a loan.

The agency market began to tighten at the end of Q1 2020 due to the COVID-19 crisis. This continued into Q2. Credit overlays have cut mortgage availability for borrowers with less than perfect credit while portfolio and private label lending have backed away from purchase originations and their market share has contracted significantly.

Home prices jump 6.7% in September, but are expected to moderate*

Prices in tourist-heavy Las Vegas and Miami expected to drop while the economy recovers

Despite home prices rising 6.7% year over year in September, CoreLogic’s Home Price Index Forecast (HPI) estimates home prices will moderate next year, increasing 0.2% nationally by September 2021 as higher prices erode affordability.

Home purchase demand managed to maintain pace through the summer, and now through the fall, as record-low mortgage rates continued to encourage new borrowers to enter the market. According to CoreLogic, it wasn’t just new home buyers, but homeowners looking to trade up or invest in a second home with rock-bottom rates who were driving the boom.

“Housing continues to be a bright spot during an otherwise challenging economic time for many U.S. households. Those in sectors that weathered the transition to remote work successfully are now able to take advantage of low mortgage rates to purchase a home for the first time or to trade up to a larger home,” said Frank Martell, president, and CEO of CoreLogic.

Data from the National Association of Realtors and U.S. Census Bureau shows that the national supply of homes for sale in September fell to the lowest level ever recorded. After months of severe shortages, upward pressure on home price appreciation had consumers battling it out for the limited supply, the report said.

“COVID has contributed to the acute shortage of inventory as the pace of new construction slowed and older prospective sellers postponed listing their homes until after the pandemic. Once the pandemic passes or a vaccine is widely administered, we should see a noticeable pick-up in for-sale homes. And if the economy’s recovery is sluggish next year, distressed sales may also add to market inventory,” said Frank Nothaft, chief economist for CoreLogic.

2020 Home Loan Volume Expected to Top a Record-Breaking $4 Trillion*

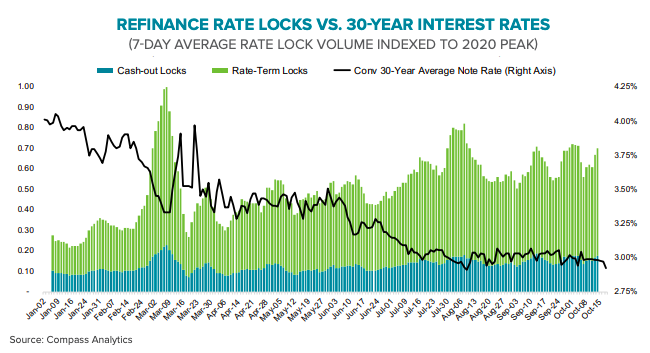

Black Knight concurs with an earlier forecast from the Mortgage Bankers Association, that 2020 will have a higher level of mortgage originations in 2020 than was registered in 2019. Black Knight, in its new Mortgage Monitor covering September loan performance data, said its interpretation of recent rate lock information suggests that, for the first time ever, the market is on track to top $4 trillion in originations.

Rate lock activity in September was relatively even with that in August increasing a nominal 1 percent. Purchase locks were down 2 percent, typical for the season, while refinance locks were essentially unchanged. However, lock activity picked up in October, rising 4 percent through the first half of the month. Purchase locks were up 6 percent and refinancing locks rose 3 percent month-over-month.

Mortgage Rates Pop Higher as Lenders Guard Against Volatility*

It’s no secret that there was a massive market reaction to the 2016 election. Even though markets don’t expect the range of potential outcomes to be nearly as wide this time, there’s no question that at least some fraction of the same amount of volatility is at stake in 2020. Mortgage lenders know this just as well as anyone. And they can defend against that volatility by raising rates.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for mortgage LO’s at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.