Welcome to iLeads Insurance Market Minute, where we bring you the latest, most relevant news regarding the cyber insurance market. Last week you were reading Is This the Next Great Opportunity for Insurance Agents? This week we’re bringing Cyber Insurance Providers:

How cyber insurance agencies can stop clients from falling through the cracks*

There is a common saying in the insurance industry: “One dollar of retained business is worth more than a dollar of new business.” Why? It takes less time, money, and effort for a cyber insurance agency to keep business on the books, compared to going out into the market and winning new business.

The average insurance agency has a client retention rate of approximately 84%. That means they have to increase their new business sales by 16% every year in order to make up for losses and break even. And if they want to grow their agency, they have to work even harder.

Insurance agencies never want to lose a client – let alone 16% of their book– but the simple truth of the matter is that “accounts sometimes fall through the cracks,” explained Chuck Keeley (pictured), senior solution consultant at EZLynx, a leading provider of insurance agency software.

“That slippage is often due to a lack of time and resources. It comes down to volume and a perceived lack of hours in a day,” Keeley told Insurance Business. “If I’m an insurance agent and I write your home and auto policies, but I don’t engage with you prior to renewal, you’re not going to feel a strong sense of loyalty to me. When you get a renewal notification in the mail, you’re going to have no hesitation shopping the market.

“The agencies with a client retention rate of 90%, or better, are the ones that are proactively engaging with clients so that the thought of shopping for their cyber insurance never even enters the customer’s mind.”

Out-of-this-world coverage in the works*

Those who were inspired by the recent space flights by billionaires Jeff Bezos and Richard Branson might soon have one less thing to worry about: insurance.

The French insurance company Axa SA is hoping to launch a line of coverage providing insurance for space travelers, Barron’s reported on Monday.

“The product that we’re working on developing would be to insure against bodily injury to the space flight participants, themselves,” Chris Kunstadter, global head of space underwriting at Axa XL, Axa SA’s commercial insurance division, told the news outlet. “That’s what we’re looking at for the future.”

While there exists insurance against space-related mishaps for rockets and other devices, there’s nothing that protects passengers, according to the outlet.

As Cyberattacks Rise, Cyber Insurance Providers Are Rethinking Their Business*

The hacks came one right after another, sowing chaos at hospitals, idling America’s biggest gasoline pipeline, crippling a huge meat supplier, and devastating hundreds of companies over the July 4 weekend.

Now, insurers are reassessing the cyber business.

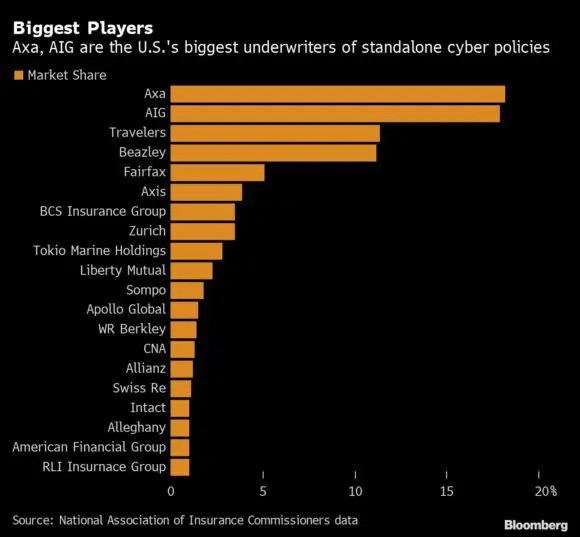

With cyberattacks on the rise and demand for coverage surging, the $3 billion industry of protecting companies against hackers is at an inflection point. Wrestling with higher costs and more risk, insurers are tightening standards, boosting prices, and slashing how much they’re willing to pay for a breach.

Making coverage harder to get may expose more companies to greater financial risk. Insurers are re-evaluating how to profit from cyber policies amid a broader debate about who should be on the hook when hacks occur — like those against Colonial Pipeline Co. and JBS SA — and what roles the government and private industry should play.

“The ways of the past no longer work into the future, but never has this coverage been needed more,” said Joshua Motta, co-founder, and chief executive officer of the insurer Coalition. “People went a little over their skis, so right now there’s been a bit of a contraction.”

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for cyber insurance agents at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.