Welcome to iLeads Insurance Market Minute, where we bring you the latest, most relevant news regarding the insurance market. Last week you were reading Carbon Limiting Tech Creates New Opportunities For Insurers. This week we’re bringing you:

Global price increases slow in Q1*

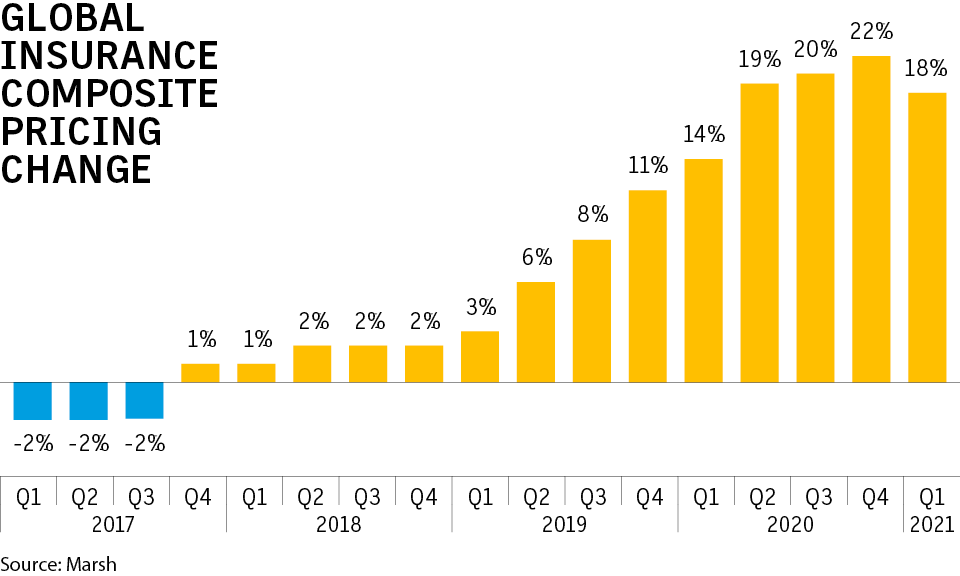

Global commercial insurance prices increased 18% in the first quarter of 2021, according to a report Tuesday from Marsh.

It was the 14th consecutive quarter of price increases but the first to show a fall in the average rate of increase since fourth-quarter 2017, as the first-quarter increase was lower than the 22% seen in the fourth quarter of 2020.

The slowing in quarterly price increases appeared to be led by generally slower rate rises in property insurance and financial and professional lines.

Global property insurance pricing was up 15% on average, less than the 20% increase in the fourth quarter of 2020. First-quarter casualty pricing was up 6% on average, compared with 7% in the prior quarter.

Although financial and professional lines saw average first-quarter pricing increases of 40%, this was down from 45% in the previous quarter.

Cyber insurance pricing increases, however, continued to grow, to 35% in the U.S. from 17% in fourth-quarter 2020 and by 29% in the U.K., higher than the 26% seen in the U.K. in fourth-quarter 2020. The continued growth in rate increases was “driven by a rise in the frequency and severity of losses,” Marsh said.

This echoed comments made last week on the broker’s first-quarter earnings call.

Pricing increases moderated generally across geographies as well. First-quarter prices in the U.S. increased 14%, down from 17% in fourth-quarter 2020. In the U.K., composite pricing increased 35%, down from 44% in fourth-quarter 2020. The Pacific region saw a 29% increase, down from 35% in fourth-quarter 2020, Marsh data showed.

Property cat bond issuance falls in Q1*

Property catastrophe bond limit placed in first-quarter 2021 declined 31.5% to $2.57 billion compared with first-quarter 2020, according to a report Tuesday from Aon Securities, part of Aon PLC.

This year’s first quarter, however, was still the third-highest, first-quarter quarterly issuance over the past 10 years.

First-quarter issuance consisted of nine property/casualty transactions by nine sponsors with an average deal size of $285 million, compared with 14 transactions by 13 sponsors in first-quarter 2020 with an average deal size of $268 million.

Property catastrophe bonds outstanding increased $450 million to $31.5 billion at the end of the quarter.

Investors appear to favor per-occurrence triggers to aggregate and are “looking to put cash to work,” Aon said.

Alternative data: The insurance industry’s (not so) secret sauce*

Insurance is a data-centric industry. Data flows through every single process from risk selection to underwriting, claims management, and reinsurance – it is the energy that keeps the industry ticking. Traditionally, it has also been a key differentiator between companies, as those with the “best” and most reliable data are able to make the most informed decisions and achieve superior business outcomes.

In today’s hyper-competitive landscape, there’s another (not so) secret sauce that insurers can use to complement their proprietary information and enhance their decision-making processes – alternative or external data sources.

“Gaining unique perspectives from alternative data sources is no longer merely an option for insurance companies; it’s become an essential part of the business strategy that’s needed to keep up with competitors,” said Omri Orgad, managing director of North America at Bright Data (formerly Luminati Networks), an SaaS platform that collects large amounts of publicly available unstructured web data and transforms it into structured usable data.

By leveraging valuable insights from publicly available data sources, insurers can enhance their decision-making in all core insurance activities, from actuarial risk assessment to premium pricing, coverage terms and conditions, loss adjusting, and so on. It also helps insurers to improve the customer experience by maximizing efficiencies and streamlining processes.

Orgad commented: “If you’re insuring five buildings in a city core, there are many risks that underwriters have to contemplate. They may want to know the distance of the buildings from a river, which ties into their flood risk. They’ll also want to know the crime risk in the area, the distances to the nearest police station and fire department, the pollution levels, and what types of businesses are surrounding those buildings – the list goes on.

“All of that data is publicly available and can be extremely useful to insurance companies. Even though the five buildings might seem to have the same risk – they have the same number of floors, same building materials, similar loss experience etc. – the actuarial risk assessment might look quite different for each building with the addition of alternative data sources. Publicly available data is making the risk assessment process more accurate, more efficient, and it’s giving insurers information that wasn’t available to them in the past.”

Orgad described Bright Data as being “on the confluence of the online data and the alternative data markets.” It’s a new industry, and, for many insurance companies, it’s completely unchartered territory.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for insurance agents at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.