Welcome back to iLeads Mortgage Market Minute, where we bring you the latest, most relevant news regarding the mortgage market. We hope you enjoyed last week’s edition where we talked about The Covid Pandemic Is Worse Than 2008 Crisis For A Majority Of Americans, Study Says. This week we’re bringing you: MBA Predicts Record Purchase Mortgage Volume In 2021

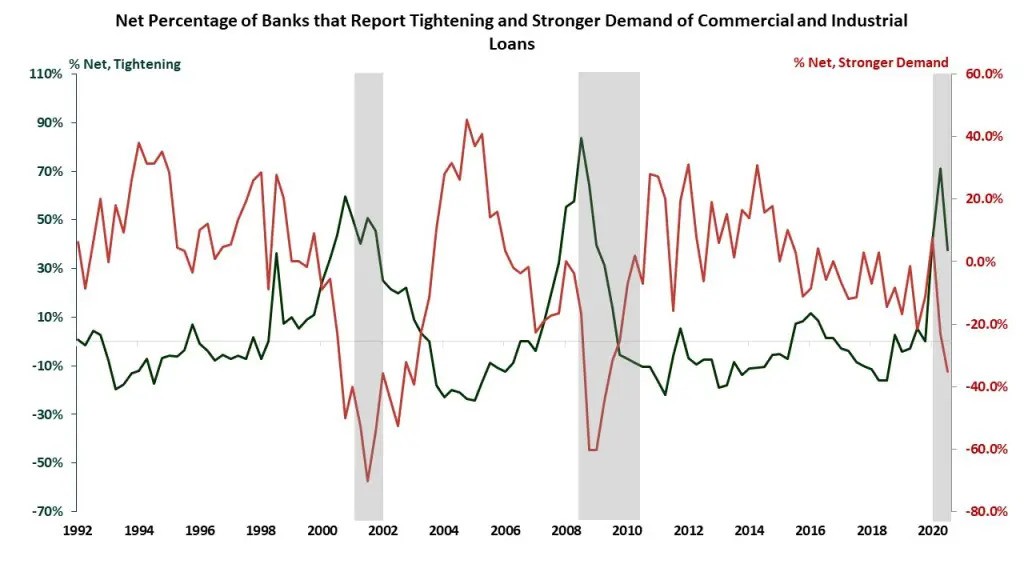

Senior Loan Officer Opinion Survey Q3 2020*

The Federal Reserve’s latest Senior Loan Officer Opinion Survey on Bank Lending Practices addresses changes in the standards and terms on, and demand for, bank loans to businesses and households. The lending data show a tightening of standards across all purposes, but sufficient demand-strength for gains in residential real estate.

For the third quarter, significant net shares of banks reported having tightened standards for commercial and industrial (C&I) loans to large, middle-market, and small firms. Meanwhile, they also continued enforcement of interest rate floors, which began in the second quarter. A significant net share of banks reported weaker demand for C&I loans to firms of all sizes during the third quarter.

In commercial real estate (CRE) lending, which includes multifamily residential real estate lending, financing construction and land development, and lending on nonfarm, nonresidential properties, a significant net share of banks reported a tightening of standards and a weaker demand.

Mortgage Rates Remain Near Recent Lows*

Mortgage rates were little-changed today, with the average lender only microscopically better than yesterday. That means few loan seekers will notice any difference from yesterday. That leaves us in line with the low rate levels seen immediately following the election earlier this month, and that’s as low as rates have been since early August, as long as we’re talking about purchase mortgage rates. Refis continue to suffer relative to purchases due to the adverse market fee imposed by Fannie Mae and Freddie Mac (rolled out by lenders at various times over the past 2 months).

Today was somewhat notable due to the fact that the bond market (normally the most important driving force for mortgage rates) told a different story. Bonds suggested rates should have moved lower more noticeably. It’s no surprise that they didn’t, however. Mortgage rates have frequently been disconnected from bonds due to unique impacts from the pandemic.

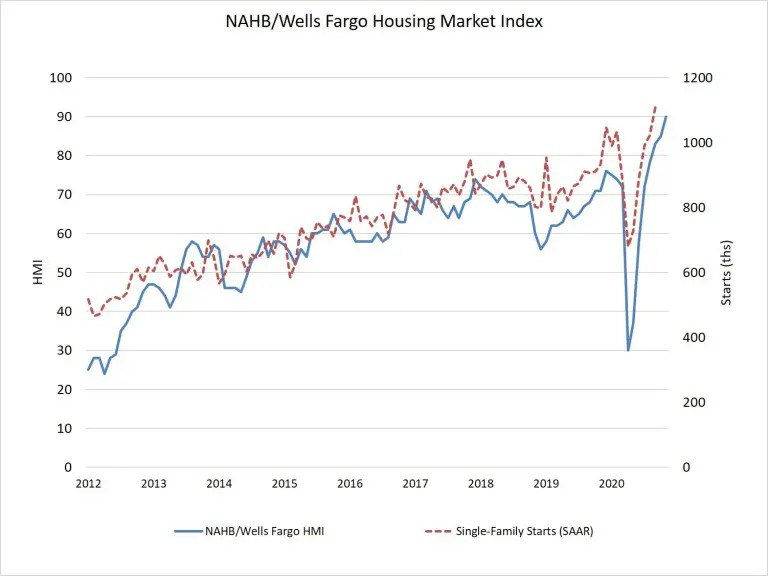

Builder Confidence Continues to Shatter Previous Records*

For the third straight month the level of builder confidence in the new home market set a record high. The National Association of Home Builders (NAHB) said the Housing Market Index (HMI) it co-sponsors with Wells Fargo soared 5 points in November to 90. This is the highest level in the 35-year history of the HMI which set records of 83 in September and 85 in October. These are the only times in its history that the Index surpassed the 80-point level and is triple its level in April when the pandemic caused it to plunge.

NAHB cautioned, however, that 69 percent of the survey responses were received before the results of the presidential election were called on Nov. 7. The election results and their future impacts on housing market conditions, will be more fully reflected in December’s HMI report.

Robert Dietz, NAHB chief economist, said that builder confidence has soared because historically low mortgage rates, favorable demographics, and an ongoing buyer preference for the suburbs have spurred demand and raised new home sales by nearly 17 percent year-over-year. He added, “Though builders continue to sign sales contracts at a solid pace, lot and material availability is holding back some building activity. Looking ahead to next year, regulatory policy risk will be a key concern given these supply-side constraints.

What the surge in COVID cases means for the housing market this winter*

Two factors to consider

With COVID infection rates exploding and hospitalization rates rising as we go into the cold winter months, the risk this poses to our recovering housing market is a question that should be addressed. In a previous article, I identified infection rates during the winter months as one of the economy’s high-risk variables.

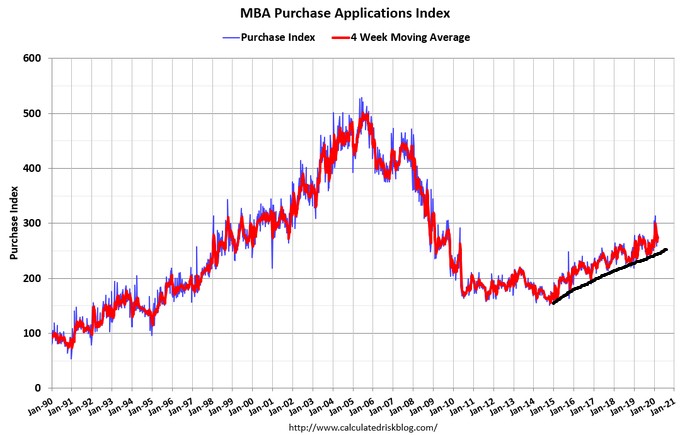

Before COVID-19 hit our shores, we were trending at 10% growth, working at cycle highs in demand. The housing heat months for the MBA purchase application data are from the second week of January to May’s first week. Typically, after May, total volumes fall as seasonality kicks in. We had double-digit growth until March 18.

Drone mapping in the real estate industry*

Drone mapping is replacing manned aerial flyovers due to high resolution and low costs

Year to year, the evolution of computer technology can be staggering. In most cases, the advancements cause disruption— and opportunity—in every industry. In real estate, one such disruption is caused by drones, which have become an extremely effective tool for mapping and marketing property.

Drone mapping is replacing manned aerial flyovers such as Google Earth, a technology the industry has relied on for decades. More than taking pictures, videos, and plotting property boundaries on a map, drone mapping provides buyers and sellers with low-cost, high-resolution, and frequently updated imagery.

Drone Mapping

Drones autonomously capture multiple overlapping images that are georeferenced and stitched together to create an orthomosaic. The orthomosaic is used just like any other layer in a GIS to serve as an accurate, high-resolution, updated aerial basemap.

Data such as boundary lines, trails, flood zones, topographic contours etc. can be laid on top of the drone imagery for mapping. Informative data such as deer stands, utilities, hog damage etc. can also be collected and plotted.

Many photogrammetric softwares are available for drone mapping, such as Pix4D, DroneDeploy. Each software has its pros and cons, but all generate more than just imagery. A standard DJI drone and camera alone can create 3D meshes, digital elevation models, and measure plant health (via VARI algorithm). The data outputs can be used to generate topographic contours, identify troubled areas in agricultural fields, or even help determine the best location to build a home or cabin.

A small, helpful practice is adding the property boundaries and descriptive text on the drone photos. Software such as Photoshop or GIMP (a free open-source alternative) can aid with editing the raster photos themselves and adding vector boundaries and text.

Although drone mapping can assist marketing efforts and helps buyers make informed decisions, it is not ideal for all properties. Properties that are too large or densely forested can cause delays in image processing or increase overall cost.

MBA predicts record purchase mortgage volume in 2021*

A rebounding economy is likely to see higher mortgage rates

The Mortgage Bankers Association on Tuesday released revised estimates for the third and fourth quarter of 2020 and predicted record purchase volume for 2021. Although the MBA expects decreased refinancings in 2021 and a decline in overall origination to around $2.56 trillion, that would still be the second-highest origination total in the last 15 years.

The rebounding economy is likely to mean higher mortgage rates, with the MBA forecasting 2.9% by the end of 2020, rising to 3.3% by Q4 2021.

The MBA is forecasting a rise in purchase originations to $1.59 trillion, which would break the previous record of $1.51 trillion set in 2005. However, the MBA sees refinances decreasing to $971 billion.

“The housing market has seen a meaningful rebound since the onset of the pandemic,” said Mike Fratantoni, MBA chief economist. “Record-low mortgage rates have led to a surge in borrower demand for refinances and home purchases.”

For 2020, the MBA is estimating $3.9 trillion in mortgage originations – the highest since 2003 and a 50% increase from 2019.

Finding highly affordable leads to keep sales coming in

At iLeads, we have many great solutions for mortgage LO’s at a low cost. If you’d like to see how we can help you bring in consistent sales for a great price, give us a call at (877) 245-3237!

We’re free and are taking phone-calls from 7AM to 5PM PST, Monday through Friday.

You can also schedule a call here.