iLeads Knows Home Owning Customers Better Than Anyone.

Now You Can Too.

iLeads combines consumer contributed intent leads with property, mortgage

and homeownership data to fuel customer intelligence and acquisition.

Mortgage. Insurance. Homeowner Marketing. Real Estate Services.

iLeads Knows Home Owning Customers Better Than Anyone.

Now You Can Too.

iLeads combines consumer contributed intent leads with property, mortgage and homeownership data to fuel customer intelligence and acquisition.

Mortgage. Insurance. Homeowner Marketing. Real Estate Services.

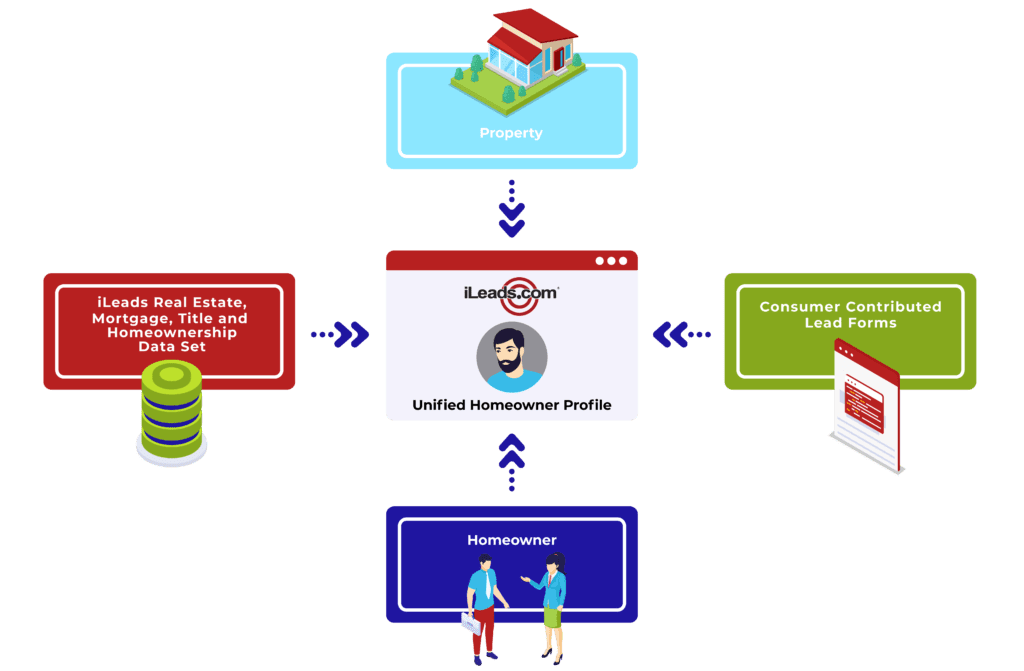

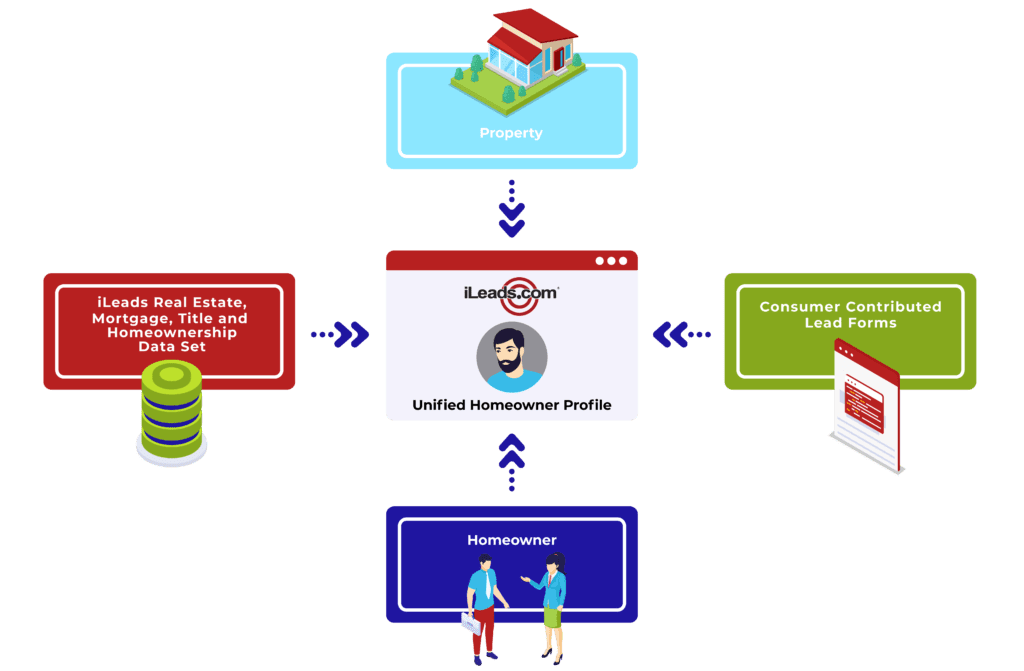

Discover A Complete View Of Property

ownership and consumer needs

The Unified Homeowner Profile is used to fuel all of our leads and customer acquisition

solutions and provides a total view of both property and homeownership information,

including consumer submitted intent signals relating to key life purchases.

All The Solutions You Need To Know, Reach and Win New Home Owning Customers

GET HOMEOWNER LEADS

Get More Than Just Leads – Get Leads Enhanced with 270+ Property and Mortgage Data Elements

Mortgage Leads

iLeads does the mortgage lead

generation for you, delivering fresh,

accurate mortgage leads tailored

to your precise qualifications.

|

Home Services Leads

Homeowners are looking to improve

and secure their homes. iLeads provides the homeowner leads that are a perfect match for your services.

|

MINE AND ENRICH YOUR CRM

Enrich the Data Already In Your CRM or Get Real Time, AI Driven Lead Enhancement

Enrich The CRM Prospects

You Already Have

Revive

Identify the loan opportunities hiding in your CRM.

Performance

Lenders: know your competitive marketing ROI.

Gain Real-Time

Lead Insight

GateKeeper

Real-time property data analysis and append for leads.

RealTag

Instantly qualify prospects with homeownership data.

Discover A Complete View Of Property ownership and consumer needs

The Unified Homeowner Profile is used to fuel all of our leads and customer acquisition solutions and provides a total view of both property and homeownership information, including consumer submitted intent signals relating to key life purchases.

All The Solutions You Need To Know, Reach and Win New Home Owning Customers

GET HOMEOWNER LEADS

Get More Than Just Leads – Get Leads Enhanced with 270+ Property and Mortgage Data Elements

Mortgage Leads

iLeads does the mortgage lead generation for you, delivering fresh, accurate mortgage leads tailored to your precise qualifications.

Home Services Leads

Homeowners are looking to improve and secure their homes. iLeads provides the homeowner leads that are a perfect match for your services.

MINE AND ENRICH YOUR CRM

Enrich the Data Already In Your CRM or Get Real Time, AI Driven Lead Enhancement

Enrich The CRM Prospects You Already Have

Revive

Identify the loan opportunities hiding in your CRM.

Performance

Lenders: know your competitive marketing ROI.

Gain Real-Time

Lead Insight

GateKeeper

Real-time property data analysis and append for leads.

RealTag

Instantly qualify prospects with homeownership data.

APIs

Leads & Property-Centric Insight

Instantly Delivered To Your App

APIs Provide Instant Access To the Most Accurate, Current Multi-sourced Property Data.

Mortgage

Get loan data indicators including property data, comparables, neighborhood data, liens and more.

Insurance

Take insurance applications to full completion with complete instant appending of property-centric data.

Solar

Instantly spot potential solar panel and roof opportunities in any neighborhood across the US.

Property

Access the most complete real estate API with 300 data points relating to a property.

HOMEOWNER MARKETING LISTS

Easily Create Your Precision

Direct to Homeowner Marketing Lists

Take Your Marketing Beyond A Simple Mailing List with The Addition of Property & Mortgage Data

Mortgage

Increase approval rates by targeting customers who match your

credit and collateral profile.

FHA and VA too!

Insurance

Identify top insurance prospects,

ex-date leads, high net worth,

life insurance, mortgage

protection and more…

Real Estate

Discover new movers, absentee owners, foreclosure prospects, recent sales, nearby

properties and more…

Homeowner

Across the nation or down the block. Reach the right homeowners

based on property, title

and lien information.

APIs

Leads & Property-Centric Insight

Instantly Delivered To Your App

APIs Provide Instant Access To

the Most Accurate, Current

Multi-sourced Property Data.

Mortgage

Get loan data indicators including property data, comparables, neighborhood data, liens and more.

Insurance

Take insurance applications to full completion with complete instant appending of property-centric data.

Solar

Instantly spot potential solar panel and roof opportunities in any neighborhood across the US.

Property

Access the most complete real estate API with 300 data points relating to a property.

HOMEOWNER MARKETING LISTS

Easily Create Your Precision

Direct to Homeowner Marketing Lists

Take Your Marketing Beyond A Simple Mailing List with The Addition of Property & Mortgage Data

Mortgage

Increase approval rates by targeting customers who match your credit and collateral profile. FHA and VA too!

Insurance

Identify top insurance prospects, ex-date leads, high net worth, life insurance, mortgage protection and more…

Real Estate

Discover new movers, absentee owners, foreclosure prospects, recent sales, nearby properties and more…

Homeowner

Across the nation or down the block. Reach the right homeowners based on property, title and lien information.

UNIFIED HOMEOWNER PROFILE

3 Ways To Leverage the Unified Homeowner Profile

To Reach the Right Customers

The Prospects You Already Have

The Future Customers We Help You Acquire

UNIFIED HOMEOWNER PROFILE

3 Ways To Leverage the Unified Homeowner Profile

To Reach the Right Customers

Data Enrichment

Entire UHP or certain attributes can enrich the data (CRM, Database, List) you already have with:

- 270+ Property data attributes

- Phone & Email

- Credit Score

- Verified Homeowner Buying Intent Signals

Active UHP Monitoring

Provide iLeads with either:

- Customer list (Revive)

- Geography

On Demand

When you need high intent mortgage, insurance, home services, or any homeowner marketing leads – NOW – iLeads has them:

- Marketing lists

- API

- Bulk

The Prospects You Already Have

Data Enrichment

Entire UHP or certain attributes can enrich the data (CRM, Database, List) you already have with:

- 270+ Property data attributes

- Phone & Email

- Credit Score

- Verified Homeowner Buying Intent Signals

Active UHP Monitoring

Provide iLeads with either:

- Customer list (Revive)

- Geography

The Future Customers

We Help You Acquire

On Demand

When you need high intent mortgage, insurance, home services, or any homeowner marketing leads – NOW – iLeads has them:

- Marketing lists

- API

- Bulk

Every Month iLeads.com Acquires Leads

That Show Actual Customer Intent

iLeads combines these intent-based consumer leads with property, mortgage and homeownership data

to fuel customer acquisition, CRM intelligence and new opportunities for your business.

Mortgage

Protect. Win. Close More Mortgage Leads with Real Time Collateral Analysis, Competitive Analysis and reviving the leads already in your CRM.

Credit, Hot Transfer and Vintage Leads too!

Insurance

From homeowners, life, auto, health, ex-date, vintage and more, you’ll know exactly who is seeking the insurance solution you offer.

Home Services

Demand for Solar is hot! And so is home security.

Discover the homeowners shopping for your home services.

Homeowner Marketing

The Unified Homeowner Profiles provide the ultimate market lists:

Real Estate Lists

Mortgage Lending Lists

Insurance Lists

Homeowner Lists

Every Month iLeads.com Acquires Leads That Show Actual Customer Intent

iLeads combines these intent-based consumer leads with property, mortgage, and homeownership data to fuel customer acquisition, CRM intelligence, and new opportunities for your business.

Mortgage

Protect. Win. Close More Mortgage Leads with Real Time Collateral Analysis, Competitive Analysis and reviving the leads already in your CRM.

Credit, Hot Transfer and Vintage Leads too!

Insurance

From homeowners, life, auto, health, ex-date, vintage and more, you’ll know exactly who is seeking the insurance solution you offer.

Home Services

Demand for Solar is hot!

And so is home security.

Discover the homeowners shopping for your home services.

Homeowner Marketing

The Unified Homeowner Profiles provide the ultimate market lists:

Real Estate Lists

Mortgage Lending Lists

Insurance Lists

Homeowner Lists

REQUEST MORE INFORMATION

Reach The Right Customers Every Time

877-245-3237

inquiries@ileads.com

567 San Nicolas Drive Suite 180 Newport Beach CA 92660

REQUEST MORE INFORMATION

Reach the Right Customers Every Time

877-245-3237

inquiries@ileads.com

567 San Nicolas Drive Suite 180 Newport Beach CA 92660

SATISFIED CLIENTS

Empowering Lead Generation Since 1996

SATISFIED CLIENTS

Empowering Lead Generation Since 1996